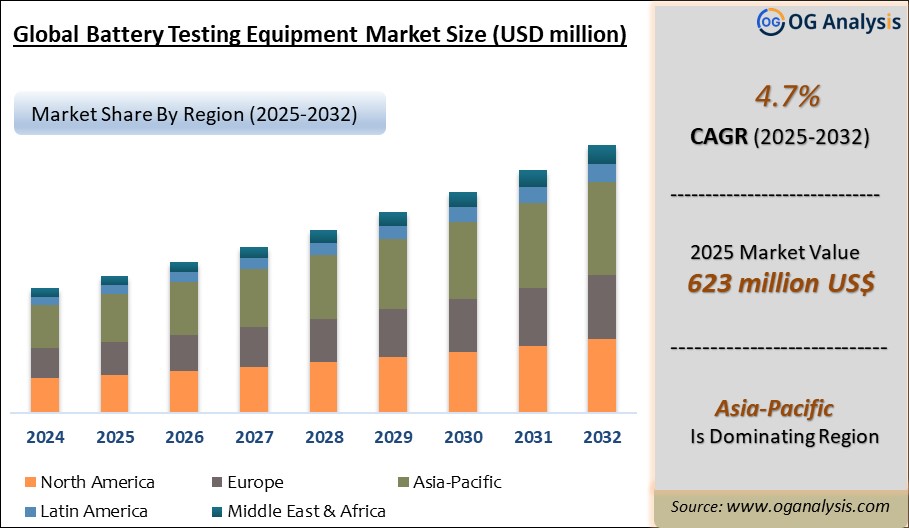

"The Global Battery Testing Equipment Market Size was valued at USD 599 million in 2024 and is projected to reach USD 623 million in 2025. Worldwide sales of Battery Testing Equipment are expected to grow at a significant CAGR of 4.7%, reaching USD 955 million by the end of the forecast period in 2034."

The Battery Testing Equipment Market is experiencing strong growth driven by the rapid adoption of electric vehicles, increasing demand for energy storage systems, and the need for safety and performance validation across battery chemistries. This market includes equipment used to test battery cells, modules, and packs for parameters such as charge capacity, cycle life, impedance, and thermal stability. Industries such as automotive, aerospace, consumer electronics, and renewable energy are relying on these tools to ensure battery reliability and compliance with regulatory standards. The shift toward lithium-ion and solid-state battery technologies is pushing manufacturers to adopt advanced testing systems that support high-precision diagnostics and scalable automation. As governments worldwide enforce strict regulations around EV safety and battery certification, the demand for versatile, standards-compliant testing equipment is rising. Asia Pacific dominates the market in both volume and growth, driven by large-scale battery production facilities in China, South Korea, and Japan. North America and Europe are also witnessing growing investment in battery testing labs, supported by clean energy initiatives, EV subsidies, and the expansion of gigafactories. With innovations in battery chemistry and safety protocols evolving rapidly, manufacturers are investing in automated, software-integrated platforms to streamline testing workflows and enhance throughput.

As the battery value chain becomes more complex, from raw materials to end-use applications, the role of battery testing equipment is expanding beyond quality control to include real-time performance optimization, R&D validation, and predictive failure analysis. Advanced testing systems now incorporate electrochemical impedance spectroscopy (EIS), AI-based diagnostics, and IoT-enabled data capture to improve battery development cycles and reduce time-to-market. The automotive sector continues to lead market share due to the proliferation of EVs, followed by growing usage in grid-scale energy storage and portable electronics. Cell-level testing remains dominant, but portable and modular test equipment is gaining popularity among service providers and decentralized test environments. Regulatory frameworks such as IEC, UN 38.3, and UNECE R100 are further catalyzing investment in high-accuracy, multi-function testing platforms. Additionally, the rise of solid-state and lithium-silicon batteries is prompting companies to develop testing solutions compatible with emerging materials and form factors. Competitive dynamics are shaped by technological innovation, strategic partnerships, and the integration of digital analytics into physical testing processes. Overall, the battery testing equipment market is poised for sustained expansion, supported by electrification trends, safety imperatives, and growing investment in battery research and production.

Stationary Battery Testing Equipment is the largest product type segment due to its widespread use in laboratories and manufacturing facilities for high-precision, automated, and long-duration testing. These systems are essential for validating cell, module, and pack performance under controlled conditions, making them integral to R&D, quality assurance, and compliance processes.

Pack Testing is the fastest-growing application segment, driven by the surge in electric vehicle production and energy storage systems that require full battery pack validation. As safety, thermal management, and performance consistency become critical, comprehensive pack-level testing is essential for regulatory approval and commercial deployment.

Key Insights

Asia Pacific holds the largest market share due to its dominance in global battery manufacturing, with leading producers in China, Japan, and South Korea demanding high-throughput testing systems to meet expanding production targets and export requirements.

Cell testing remains the largest segment as it forms the basis for evaluating battery performance in terms of cycle life, capacity, internal resistance, and safety before scale-up into modules and packs during manufacturing and R&D processes.

Portable battery testers are witnessing the fastest growth due to their ease of use, cost-efficiency, and suitability for on-site maintenance, service centers, and field diagnostics across automotive, telecom, and industrial applications.

Stationary testing equipment holds a major revenue share, especially in lab-based settings for high-accuracy, automated performance evaluations and compliance testing of battery packs under controlled temperature and load cycling conditions.

The automotive sector is the largest end-use segment, driven by growing EV adoption, government mandates for battery safety, and OEM requirements for real-time battery validation throughout development and production cycles.

Energy and utilities represent the fastest-growing end-use category, supported by the global rise in grid-scale energy storage, renewable energy integration, and the deployment of large-format lithium-ion battery installations.

Lithium-ion batteries account for the majority of testing demand due to widespread use in EVs and electronics, while solid-state battery testing is gaining momentum with rising R&D and pilot production of next-gen energy storage technologies.

Regulatory compliance is a key driver, with growing adherence to standards like IEC 62133, UN 38.3, and UNECE R100 pushing manufacturers to invest in advanced, multi-parameter battery testing systems that ensure international safety certification.

Integration of advanced analytics, including electrochemical impedance spectroscopy and real-time monitoring software, is enabling predictive insights and faster feedback loops in battery design, diagnostics, and safety profiling.

North America is experiencing a surge in demand, propelled by investments in domestic battery production, clean energy policies, and automotive electrification, with testing equipment suppliers scaling to meet regional quality and compliance needs.

Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product Type, By Application, By Capacity, By End User |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

- By Product Type

- Stationary Battery Testing Equipment

- Portable Battery Testing Equipment

- By Application

- Module Testing

- Pack Testing

- By Capacity

- below 400 V

- 401-800 V

- above 800 V

- By End User

- Automotive

- Industrial

- Electronics and Semiconductor

- Healthcare

- Energy and Utility

- Other End Uses

- By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

What You Receive

• Global Battery Testing Equipment market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Battery Testing Equipment.

• Battery Testing Equipment market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Battery Testing Equipment market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Battery Testing Equipment market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Battery Testing Equipment market, Battery Testing Equipment supply chain analysis.

• Battery Testing Equipment trade analysis, Battery Testing Equipment market price analysis, Battery Testing Equipment Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Battery Testing Equipment market news and developments.

The Battery Testing Equipment Market international scenario is well established in the report with separate chapters on North America Battery Testing Equipment Market, Europe Battery Testing Equipment Market, Asia-Pacific Battery Testing Equipment Market, Middle East and Africa Battery Testing Equipment Market, and South and Central America Battery Testing Equipment Markets. These sections further fragment the regional Battery Testing Equipment market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Battery Testing Equipment market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Battery Testing Equipment market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Battery Testing Equipment market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Battery Testing Equipment business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Battery Testing Equipment Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Battery Testing Equipment Pricing and Margins Across the Supply Chain, Battery Testing Equipment Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Battery Testing Equipment market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Battery Testing Equipment Market is estimated to reach USD 865 million by 2032.

The Global Battery Testing Equipment Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.7% during the forecast period from 2025 to 2032.

The Global Battery Testing Equipment Market is estimated to generate USD 599 million in revenue in 2024.

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!