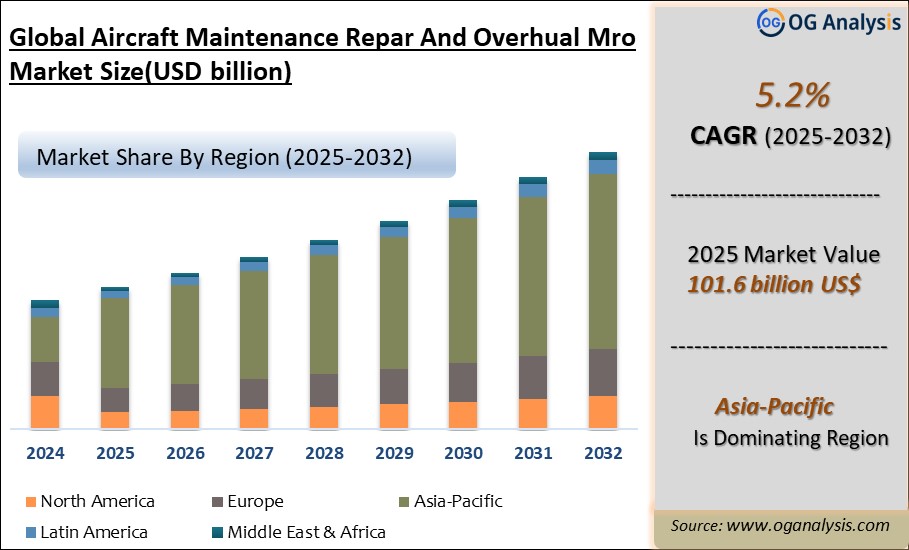

"The Global Aircraft Maintenance, Repair, and Overhaul (MRO) Market Size was valued at USD 97.2 billion in 2024 and is projected to reach USD 101.6 billion in 2025. Worldwide sales of Aircraft Maintenance, Repair, and Overhaul (MRO) are expected to grow at a significant CAGR of 5.2%, reaching USD 163.2 billion by the end of the forecast period in 2034."

Introduction and Market Overview

The Aircraft Maintenance, Repair, and Overhaul (MRO) market is a vital component of the global aviation industry, ensuring the safety, efficiency, and longevity of aircraft. This market encompasses a wide range of activities including routine maintenance, extensive repairs, and comprehensive overhauls, all of which are critical to the operation of both commercial and military aircraft. With the increasing global fleet size and the rising demand for air travel, the MRO market has seen substantial growth. Technological advancements, regulatory requirements, and the need for operational efficiency drive continuous investments in MRO services. The market is characterized by a mix of established players and new entrants, all striving to offer innovative solutions to enhance aircraft performance and reduce downtime. As aviation evolves, the MRO market remains indispensable, supporting the industry's expansion and ensuring compliance with stringent safety standards.

Latest Trends in the MRO Market

One of the latest trends in the Aircraft MRO market is the adoption of advanced digital technologies. Digital twins, predictive maintenance, and big data analytics are revolutionizing how maintenance activities are planned and executed. These technologies enable more accurate forecasting of maintenance needs, thus reducing unexpected downtime and optimizing the use of resources. Additionally, the integration of Internet of Things (IoT) devices and sensors in aircraft systems provides real-time data, enhancing the monitoring and management of aircraft health. Another emerging trend is the increasing use of 3D printing for the production of aircraft parts. This technology allows for rapid prototyping and on-demand manufacturing, significantly reducing lead times and costs associated with traditional manufacturing processes.

The MRO market is also witnessing a shift towards more sustainable practices. Environmental concerns and regulatory pressures are driving the adoption of greener technologies and processes within the industry. Companies are exploring the use of eco-friendly materials, energy-efficient practices, and waste reduction strategies to minimize their environmental footprint. The use of sustainable aviation fuel (SAF) in maintenance operations is gaining traction, reflecting the industry's commitment to reducing carbon emissions. Furthermore, partnerships and collaborations are becoming increasingly common, with MRO providers working closely with airlines, OEMs, and technology firms to develop innovative solutions that promote sustainability.

Another significant trend is the rise of Maintenance-as-a-Service (MaaS) models. This approach allows airlines to outsource their maintenance activities to specialized MRO providers, offering flexibility and cost savings. MaaS models provide airlines with access to advanced maintenance capabilities without the need for significant capital investments in infrastructure and technology. This trend is particularly beneficial for smaller airlines and those operating in regions with limited MRO facilities. The growing emphasis on MaaS reflects the broader industry move towards more efficient and scalable business models that can adapt to the dynamic nature of the aviation sector.

Global Aircraft Maintenance, Repair, and Overhaul (MRO) market Analysis 2025-2032: Industry Size, Share, Growth Trends, Competition and Forecast Report

Key Drivers of the MRO Market

The growth of the Aircraft MRO market is driven by several key factors. First and foremost is the expanding global fleet size. As more aircraft enter service, the demand for maintenance, repair, and overhaul services increases correspondingly. The rising number of air passengers and the subsequent increase in flight hours necessitate regular maintenance to ensure safety and compliance with regulatory standards. Additionally, aging aircraft require more frequent and extensive maintenance, further fueling the demand for MRO services. Economic growth in emerging markets is also contributing to the expansion of the aviation sector, thereby driving the MRO market.

Technological advancements are another major driver of the MRO market. Innovations in aircraft design and materials, such as the use of composite materials and advanced avionics, require specialized maintenance expertise and equipment. The introduction of new-generation aircraft with sophisticated systems and components necessitates ongoing training and investment in advanced diagnostic tools and techniques. Furthermore, regulatory requirements related to aircraft safety and maintenance standards are becoming increasingly stringent. Compliance with these regulations demands continuous investments in MRO capabilities and adherence to best practices, ensuring that aircraft remain airworthy and meet safety standards.

Cost efficiency is also a significant driver in the MRO market. Airlines are constantly seeking ways to reduce operational costs and enhance profitability. Efficient MRO services help airlines achieve these goals by minimizing aircraft downtime and optimizing maintenance schedules. Predictive maintenance, enabled by data analytics and digital technologies, allows for timely identification and resolution of potential issues, reducing the likelihood of costly repairs and unscheduled maintenance events. Additionally, the trend towards outsourcing MRO services to specialized providers allows airlines to leverage economies of scale and access advanced maintenance capabilities without incurring significant capital expenditures.

Market Challenges

Despite its growth prospects, the Aircraft MRO market faces several challenges. One of the primary challenges is the high cost of maintenance operations. The investment required for advanced diagnostic tools, specialized equipment, and skilled labor is substantial. Additionally, the increasing complexity of modern aircraft systems necessitates continuous training and upskilling of maintenance personnel, further adding to operational costs. Another significant challenge is the shortage of skilled labor. The demand for experienced technicians and engineers often exceeds supply, leading to potential delays and increased labor costs. The industry must address this talent gap to ensure the availability of qualified personnel to meet the growing maintenance needs.

Regulatory compliance is another challenge for the MRO market. Aircraft maintenance is subject to stringent regulations and standards set by aviation authorities worldwide. Compliance with these regulations requires significant investments in quality control, documentation, and certification processes. Any lapses in compliance can result in severe penalties and operational disruptions. Moreover, the global nature of the aviation industry means that MRO providers must navigate a complex regulatory landscape, with varying requirements in different regions. Ensuring consistent compliance across multiple jurisdictions can be resource-intensive and challenging.

Furthermore, the MRO market is highly competitive, with numerous players vying for market share. The presence of established companies and new entrants intensifies competition, driving the need for continuous innovation and differentiation. MRO providers must invest in advanced technologies, efficient processes, and customer-centric solutions to stay ahead in the market. Additionally, geopolitical factors, economic uncertainties, and fluctuating fuel prices can impact the aviation industry, influencing the demand for MRO services. Providers must remain agile and resilient to navigate these external challenges and sustain their market position.

Major Players in the MRO Market

1. AAR Corporation

2. Airbus SAS

3. Boeing Global Services

4. Delta TechOps

5. GE Aviation

6. Lufthansa Technik AG

7. MTU Aero Engines AG

8. Rolls-Royce Holdings PLC

9. SIA Engineering Company

10. SR Technics

11. ST Aerospace

12. Turkish Technic Inc.

13. United Technologies Corporation

14. Air France Industries KLM Engineering & Maintenance

15. Safran Aircraft Engines

| Parameter | Detail |

| Base Year

| 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By MRO Type, By Air-craft Type and By service Provider |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

The Aircraft MRO market can be segmented based on several criteria:

By MRO Type:

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Component Maintenance

By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Helicopters

By Service Provider:

- Independent MROs

- Airline-affiliated MROs

- OEM-affiliated MROs

By Geography:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

Aircraft Maintenance, Repair, and Overhaul (MRO) market estimated to reach USD 145.8 billion by 2032

The Aircraft MRO market refers to the industry that provides maintenance, repair, and overhaul services for commercial, military, and general aviation aircraft. These services ensure aircraft safety, airworthiness, compliance with regulations, and operational efficiency throughout their lifecycle.

The market is segmented into line maintenance, heavy maintenance, engine overhaul, component maintenance, and modifications. Each segment addresses specific aspects of maintaining and repairing aircraft systems and structures.

Asia-Pacific leads the market, driven by rapid fleet expansion and rising air travel in China, India, and Southeast Asia. North America and Europe follow, supported by mature aviation sectors and established MRO infrastructure.

Trends include increased use of predictive maintenance powered by AI and big data, digital twin technology, outsourcing of MRO activities to third-party providers, and a growing focus on sustainability and green MRO practices.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!