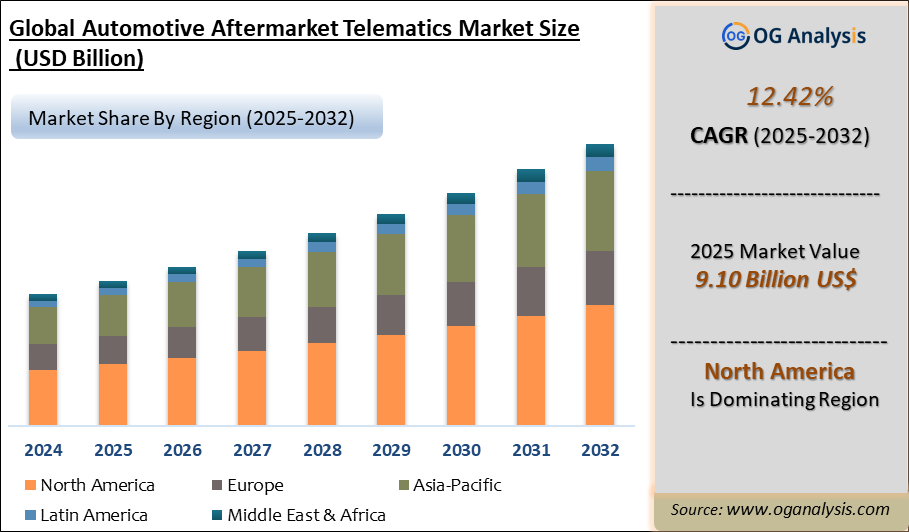

The Automotive Aftermarket Telematics Market is estimated to be USD 8.1 billion in 2024. Furthermore, the market is expected to grow to USD 18.4 billion by 2031, with a Compound Annual Growth Rate (CAGR) of 12.42%.

The Automotive Aftermarket Telematics Market refers to plug-and-play and hardwired devices installed post-sale to enhance vehicle connectivity, fleet management, safety, and diagnostics. These systems offer features such as GPS-based tracking, remote diagnostics, predictive maintenance alerts, driver behavior monitoring, and smartphone integration. The market has surged due to rising demand from fleet operators, insurance programs offering usage-based insurance (UBI), and growing consumer interest in connected car functionality regardless of OEM-provided systems. Telematics devices extend the useful life of vehicles, improve operational efficiency, and empower real-time vehicle monitoring, making them appealing to commercial fleets, rental agencies, ride-hailing services, and individual drivers seeking enhanced safety and convenience.

Growth drivers include declining hardware costs, improved cellular networks like 4G/5G, and integration with cloud and AI platforms for advanced analytics. Regional dynamics vary: North America remains the largest market due to mature fleet telematics adoption and favorable regulatory environments, while Europe follows with strong UBI and smart transport initiatives. Asia-Pacific is rapidly growing as logistics and rideshare usage expand and telematics adoption rises in China and India. Challenges include data privacy concerns, interoperability across diverse vehicle models, and increasing cybersecurity requirements. However, innovation in modular sensor add-ons, over-the-air updates, and integration with digital ecosystems (insurance, smart cities, predictive services) continues to stimulate market evolution and resilience beyond OEM adoption.

By connectivity, embedded is the largest segment in the automotive aftermarket telematics market as it offers seamless integration with vehicle systems, enabling real-time data transmission, enhanced security, and consistent connectivity without reliance on external devices, making it preferred by fleet operators and premium vehicle owners.

By service, vehicle tracking & fleet management is the largest segment as commercial fleets and logistics operators adopt telematics solutions to optimise routes, monitor vehicle locations, improve operational efficiency, and reduce fuel and maintenance costs, driving strong demand globally across transport and logistics industries.

Key Insights

- Fleet operators deploy aftermarket telematics to improve route optimization, reduce fuel consumption, and support maintenance scheduling, yielding substantial cost savings and regulatory compliance in logistics operations.

- Usage-based insurance programs are expanding adoption, as insurers use telematics data to assess driver behavior to offer personalized premiums, rewards, and risk-based pricing models.

- OEM-independent plug-and-play telematics devices are gaining traction among private vehicle owners seeking connected features—such as remote diagnostics, tracking, and theft prevention—without dealership dependency.

- Integration with mobile apps and cloud platforms enables real-time alerts, vehicle health tracking, and driver performance analytics, enhancing user engagement and value perception.

- Advanced hardware modules with 4G/5G, Bluetooth, and CAN-Bus access provide improved data collection accuracy and enable flash updates, expanding feature adaptability and lifespan.

- Telematics solutions tailored for rental and ride‑hail fleets include driver ID modules and trip-level analytics to ensure asset utilization transparency and regulatory compliance.

- 48V mild-hybrid and electric vehicle telematics are emerging as OEM systems leave gaps, prompting aftermarket device makers to offer battery health monitoring and charging behavior insights.

- Data privacy regulations such as GDPR and CCPA are prompting telematics providers to enhance encryption, anonymization, and user-consent management in aftermarket solutions.

- Strategic alliances between hardware providers, software platforms, and insurers are expanding bundled telematics offerings that combine device, data analytics, and service components.

- Cybersecurity-enabled telematics units are being designed with intrusion detection and OTA authentication to defend against hacking and ensure secure vehicle connectivity. Reort Scope

| Parameter | Detail |

|---|---|

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2034 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Connectivity, By Service, By Vehicle |

| Countries Covered |

North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10 % free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

Automotive Aftermarket Telematics Market, By Connectivity

- Embedded

- Tethered

- Integrated

Automotive Aftermarket Telematics Market, By Service

- Vehicle Tracking & Fleet Management

- Navigation

- Road Side Assistance

- Wi-Fi hotspot

- Vehicle Diagnostics

- Driver Behavior & Control

- Others

Automotive Aftermarket Telematics Market, By Vehicle

- Passenger Cars

- Commercial Vehicles

Automotive Aftermarket Telematics Market, By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Malaysia, Vietnam, Rest of APAC)

- The Middle East and Africa (Saudi Arabia, South Africa, UAE, Iran, Egypt, Rest of MEA)

- South and Central America (Brazil, Argentina, Chile, Rest of SCA)

What You Receive

• Global Automotive After market size and growth projections (CAGR), 2024- 2034• Impact of recent changes in geopolitical, economic, and trade policies on the demand and supply chain of Automotive After.

• Automotive After market size, share, and outlook across 5 regions and 27 countries, 2025- 2034.

• Automotive After market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2025- 2034.

• Short and long-term Automotive After market trends, drivers, restraints, and opportunities.

• Porter’s Five Forces analysis, Technological developments in the Automotive After market, Automotive After supply chain analysis.

• Automotive After trade analysis, Automotive After market price analysis, Automotive After Value Chain Analysis.

• Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products.

• Latest Automotive After market news and developments.

The Automotive After Market international scenario is well established in the report with separate chapters on North America Automotive After Market, Europe Automotive After Market, Asia-Pacific Automotive After Market, Middle East and Africa Automotive After Market, and South and Central America Automotive After Markets. These sections further fragment the regional Automotive After market by type, application, end-user, and country.

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways1. The report provides 2024 Automotive After market sales data at the global, regional, and key country levels with a detailed outlook to 2034, allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.

2. The research includes the Automotive After market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Automotive After market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Automotive After business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Automotive After Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below :

Segmentation of choice – Our clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

Automotive After Pricing and Margins Across the Supply Chain, Automotive After Price Analysis / International Trade Data / Import-Export Analysis

Supply Chain Analysis, Supply–Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Automotive After market analytics

Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Customization of up to 10% of the content can be done without any additional charges.

Note: Latest developments will be updated in the report and delivered within 2 to 3 working days.

TABLE OF CONTENTS

1. GLOBAL AUTOMOTIVE AFTERMARKET TELEMATICS INDUSTRY

1.1. Market Scope and Definition

1.2. Study Assumptions

2. AUTOMOTIVE AFTERMARKET TELEMATICS MARKET LATEST TRENDS, DRIVERS AND CHALLENGES, 2023-2031

2.1. Automotive Aftermarket Telematics Market Overview

2.2. Automotive Aftermarket Telematics Market Latest Trends

2.2.1. Growing demand for connected vehicles and advanced telematics services

2.2.2. Cloud-based telematics services witnessing rapid demand Growth

2.2.3. Increasing Telematics Services offered at free/minimal costs

2.3. Automotive Aftermarket Telematics Market Insights, 2023-2031

2.3.1. Leading Automotive Aftermarket Telematics Connectivity, 2023-2031

2.3.2. Leading Automotive Aftermarket Telematics Service, 2023-2031

2.3.3. Fast-Growing Regions for Automotive Aftermarket Telematics Sales, 2023-2031

2.4. Automotive Aftermarket Telematics Market Drivers and Restraints

2.4.1. Automotive Aftermarket Telematics Demand Drivers to 2031

2.4.2. Automotive Aftermarket Telematics Challenges to 2031

3. GLOBAL AUTOMOTIVE AFTERMARKET TELEMATICS MARKET VALUE, MARKET SHARE, AND FORECAST to 2031

3.1. Global Automotive Aftermarket Telematics Market Overview, 2023

3.2. Global Automotive Aftermarket Telematics Market Size and Share Outlook, By Connectivity, 2023-2031

3.2.1. Embedded

3.2.2. Tethered

3.2.3. Integrated

3.3. Global Automotive Aftermarket Telematics Market Size and Share Outlook, By Service, 2023-2031

3.3.1. Vehicle Tracking & Fleet Management

3.3.2. Navigation

3.3.3. Road Side Assistance

3.3.4. Wi-Fi hotspot

3.3.5. Vehicle Diagnostics

3.3.6. Driver Behavior & Control

3.3.7. Others

3.4. Global Automotive Aftermarket Telematics Market Size and Share Outlook, By Vehicle, 2023-2031

3.4.1. Passenger Cars

3.4.2. Commercial Vehicles

3.5. Global Automotive Aftermarket Telematics Market Size and Share Outlook by Region, 2023-2031

4. ASIA PACIFIC AUTOMOTIVE AFTERMARKET TELEMATICS MARKET VALUE, MARKET SHARE, AND FORECAST to 2031

4.1. Asia Pacific Automotive Aftermarket Telematics Market Overview, 2023

4.2. Asia Pacific Automotive Aftermarket Telematics Market Size and Share Outlook, By Connectivity, 2023-2031

4.3. Asia Pacific Automotive Aftermarket Telematics Market Size and Share Outlook, By Service, 2023-2031

4.4. Asia Pacific Automotive Aftermarket Telematics Market Size and Share Outlook, By Vehicle, 2023-2031

4.5. Asia Pacific Automotive Aftermarket Telematics Market Size and Share Outlook by Country, 2023-2031

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Rest of Asia Pacific

5. EUROPE AUTOMOTIVE AFTERMARKET TELEMATICS MARKET VALUE, MARKET SHARE, AND FORECAST to 2031

5.1. Europe Automotive Aftermarket Telematics Market Overview, 2023

5.2. Europe Automotive Aftermarket Telematics Market Size and Share Outlook, By Connectivity, 2023-2031

5.3. Europe Automotive Aftermarket Telematics Market Size and Share Outlook, By Service, 2023-2031

5.4. Europe Automotive Aftermarket Telematics Market Size and Share Outlook, By Vehicle, 2023-2031

5.5. Europe Automotive Aftermarket Telematics Market Size and Share Outlook by Country, 2023-2031

5.5.1. Germany

5.5.2. United Kingdom

5.5.3. France

5.5.4. Spain

5.5.5. Rest of Europe

6. NORTH AMERICA AUTOMOTIVE AFTERMARKET TELEMATICS MARKET VALUE, MARKET SHARE AND FORECAST to 2031

6.1. North America Automotive Aftermarket Telematics Market Overview, 2023

6.2. North America Automotive Aftermarket Telematics Market Size and Share Outlook, By Connectivity, 2023-2031

6.3. North America Automotive Aftermarket Telematics Market Size and Share Outlook, By Service, 2023-2031

6.4. North America Automotive Aftermarket Telematics Market Size and Share Outlook, By Vehicle, 2023-2031

6.5. North America Automotive Aftermarket Telematics Market Size and Share Outlook by Country, 2023-2031

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. SOUTH AND CENTRAL AMERICA AUTOMOTIVE AFTERMARKET TELEMATICS MARKET VALUE, MARKET SHARE AND FORECAST to 2031

7.1. South and Central America Automotive Aftermarket Telematics Market Overview, 2023

7.2. South and Central America Automotive Aftermarket Telematics Market Size and Share Outlook, By Connectivity, 2023-2031

7.3. South and Central America Automotive Aftermarket Telematics Market Size and Share Outlook, By Service, 2023-2031

7.4. South and Central America Automotive Aftermarket Telematics Market Size and Share Outlook, By Vehicle, 2023-2031

7.5. South and Central America Automotive Aftermarket Telematics Market Size and Share Outlook by Country, 2023-2031

7.5.1. Brazil

7.5.2. Argentina

7.5.3. Rest of South and Central America

8. MIDDLE EAST AFRICA AUTOMOTIVE AFTERMARKET TELEMATICS MARKET VALUE, MARKET SHARE AND FORECAST to 2031

8.1. Middle East Africa Automotive Aftermarket Telematics Market Overview, 2023

8.2. Middle East Africa Automotive Aftermarket Telematics Market Size and Share Outlook, By Connectivity, 2023-2031

8.3. Middle East Africa Automotive Aftermarket Telematics Market Size and Share Outlook, By Service, 2023-2031

8.4. Middle East Africa Automotive Aftermarket Telematics Market Size and Share Outlook, By Vehicle, 2023-2031

8.5. Middle East Africa Automotive Aftermarket Telematics Market Size and Share Outlook by Country, 2023-2031

8.5.1. Middle East

8.5.2. Africa

9. AUTOMOTIVE AFTERMARKET TELEMATICS MARKET STRUCTURE

9.1. GEA Group AG

9.2. Visteon Corporation

9.3. Delphi Technologies PLC

9.4. GeoTab

9.5. Continental AG

10. APPENDIX

10.1. About Us

10.2. Sources

10.3. Research Methodology

10.4. Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Automotive AfterMarket is estimated to generate USD 8.1 billion in revenue in 2024.

The Global Automotive AfterMarket is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.42% during the forecast period from 2025 to 2032.

The Automotive AfterMarket is estimated to reach USD 20.7 billion by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!