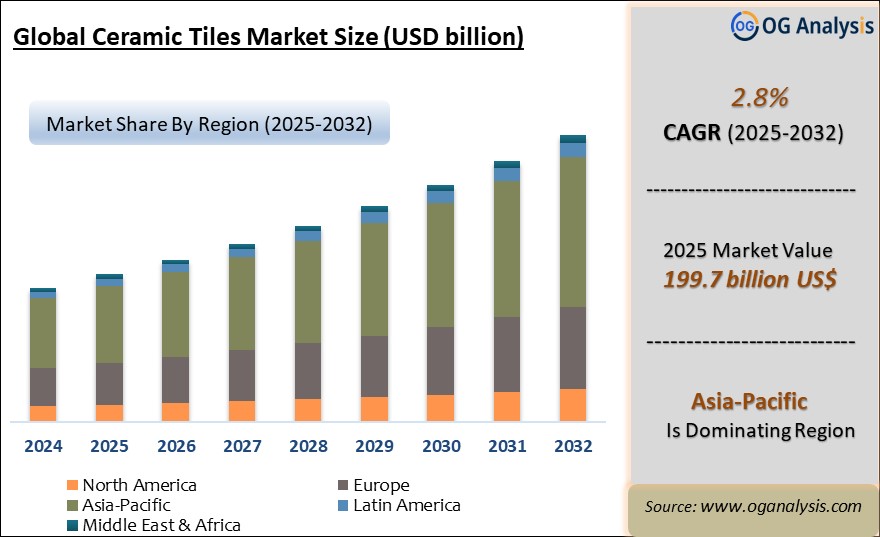

"The Global Ceramic Tiles Market Size was valued at USD 195.0 billion in 2024 and is projected to reach USD 199.7 billion in 2025. Worldwide sales of Ceramic Tiles are expected to grow at a significant CAGR of 2.8%, reaching USD 259.8 billion by the end of the forecast period in 2034."

Introduction and Overview

The global ceramic tiles market has witnessed substantial growth over the past decade, driven by increasing urbanization and rising disposable incomes. Ceramic tiles, known for their durability, aesthetic appeal, and low maintenance requirements, have become a popular choice in both residential and commercial settings. This market encompasses various types of ceramic tiles, including floor, wall, and decorative tiles, which are utilized in diverse applications from flooring and countertops to backsplash and exterior facades. The versatility of ceramic tiles, combined with advancements in technology that allow for intricate designs and improved performance, has bolstered their demand worldwide.

Geographically, Asia-Pacific dominates the ceramic tiles market due to rapid industrialization and urban growth in countries like China and India. However, regions such as North America and Europe are also experiencing steady growth, driven by renovations and new construction projects. The market is characterized by a competitive landscape with numerous global and regional players, leading to continuous innovation and product development. Companies are increasingly focusing on sustainability and eco-friendly manufacturing processes to cater to the evolving preferences of environmentally conscious consumers. Overall, the ceramic tiles market is poised for further expansion, supported by ongoing advancements and increasing consumer adoption.

Asia-Pacific is the leading region in the Ceramic Tiles Market, fueled by rapid urbanization, robust construction activities, and increasing demand for affordable housing across emerging economies.

Ceramic Tiles Market Trends

One of the prominent trends in the ceramic tiles market is the growing popularity of large-format tiles. These tiles, which often exceed standard sizes, are favored for their sleek appearance and minimal grout lines, creating a more seamless and modern look. Additionally, advancements in digital printing technologies have enabled manufacturers to produce tiles that mimic natural materials such as wood and stone with high accuracy, offering an attractive alternative to traditional materials. The rise in design versatility has expanded the applications of ceramic tiles beyond traditional settings, making them suitable for innovative uses in contemporary interior designs.

Another key trend is the increasing emphasis on eco-friendly and sustainable practices within the industry. Many manufacturers are adopting green technologies and utilizing recycled materials in tile production to minimize environmental impact. This shift aligns with the broader global movement towards sustainability and is driven by growing consumer demand for environmentally responsible products. As consumers become more conscious of their ecological footprint, the market for green ceramic tiles is expected to grow, offering opportunities for companies to differentiate themselves and appeal to a more environmentally aware clientele.

Smart home integration is also making its mark on the ceramic tiles market. Innovations such as smart tiles embedded with sensors for temperature control, lighting, or even interactive features are emerging trends. These technological advancements cater to the increasing demand for connected and intelligent home solutions. As consumers seek to enhance their living environments with smart technologies, the integration of such features into ceramic tiles presents a new frontier for market growth and differentiation, appealing to tech-savvy and luxury-oriented segments.

Ceramic Tiles Market Drivers

The growth of the ceramic tiles market is significantly driven by the booming construction industry, fueled by rising urbanization and infrastructure development. As cities expand and new residential and commercial properties are constructed, the demand for ceramic tiles increases due to their aesthetic appeal and functionality. The durability and ease of maintenance of ceramic tiles make them an ideal choice for high-traffic areas and various applications, further supporting their widespread adoption in new building projects and renovations.

Additionally, the rise in disposable incomes and changing lifestyles contribute to the market's expansion. As individuals have more financial resources, they are investing in home improvement and luxury upgrades, including high-quality ceramic tiles. The increasing focus on interior design and personalization has led to a higher demand for diverse and customizable tile options, driving growth in the market. Furthermore, the availability of a wide range of designs, colors, and finishes allows consumers to achieve their desired aesthetic, making ceramic tiles a popular choice for modern interiors.

Technological advancements in tile production also play a crucial role in driving market growth. Innovations such as digital printing and improved manufacturing processes have enhanced the quality and variety of ceramic tiles, offering consumers more options and better performance. These advancements not only enable the creation of more intricate and attractive designs but also improve the functionality of tiles, such as better resistance to stains and wear. As technology continues to evolve, the ceramic tiles market is expected to benefit from enhanced product offerings and increased consumer appeal.

Ceramic Tiles Market Challenges

Despite its growth, the ceramic tiles market faces several challenges that could impact its trajectory. One major challenge is the fluctuation in raw material prices, which can affect manufacturing costs and, consequently, product pricing. Variations in the costs of materials such as clay, silica, and other key components can lead to price instability and affect profit margins for manufacturers. Additionally, the market is highly competitive, with numerous players vying for market share. This competition can lead to price wars and increased pressure on companies to continuously innovate and improve their offerings to maintain a competitive edge. Moreover, environmental regulations and the need for sustainable practices pose challenges for manufacturers in terms of compliance and adapting production processes to meet regulatory standards. Addressing these challenges effectively will be crucial for sustaining growth and ensuring long-term success in the ceramic tiles market.

Market Players

1. Ceramiche Caesar S.p.A.

2. China Ceramics Co. Ltd.

3. Crossville Inc.

4. Florim Ceramiche S.p.A.

5. Johnson Tiles

6. Kajaria Ceramics Limited

7. Marazzi Group S.r.l.

8. Mohawk Industries

9. Porcelanosa Grupo

10. RAK Ceramics PJSC

11. Siam Cement Group

12. Somany Ceramics Limited

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Product, By Application, By End use |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product

- Glazed ceramic tiles

- Porcelain tiles

- Scratch free ceramic tiles

- Others

By Application

- Wall tiles

- Floor tiles

- Other

By End Use

- Residential

- Commercial

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Ceramic Tiles Market Latest Trends, Drivers and Challenges, 2024- 2034

2.1 Ceramic Tiles Market Overview

2.2 Key Strategies of Leading Ceramic Tiles Companies

2.3 Ceramic Tiles Market Insights, 2024- 2034

2.3.1 Leading Ceramic Tiles Types, 2024- 2034

2.3.2 Leading Ceramic Tiles End-User industries, 2024- 2034

2.3.3 Fast-Growing countries for Ceramic Tiles sales, 2024- 2034

2.4 Ceramic Tiles Market Drivers and Restraints

2.4.1 Ceramic Tiles Demand Drivers to 2034

2.4.2 Ceramic Tiles Challenges to 2034

2.5 Ceramic Tiles Market- Five Forces Analysis

2.5.1 Ceramic Tiles Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Ceramic Tiles Market Value, Market Share, and Forecast to 2034

3.1 Global Ceramic Tiles Market Overview, 2024

3.2 Global Ceramic Tiles Market Revenue and Forecast, 2024- 2034 (US$ Million)

3.3 Global Ceramic Tiles Market Size and Share Outlook By Product, 2024- 2034

3.3.1 Glazed ceramic tiles

3.3.2 Porcelain tiles

3.3.3 Scratch free ceramic tiles

3.3.4 Others

3.4 Global Ceramic Tiles Market Size and Share Outlook By Application, 2024- 2034

3.4.1 Wall tiles

3.4.2 Floor tiles

3.4.3 Other

3.5 Global Ceramic Tiles Market Size and Share Outlook By End Use, 2024- 2034

3.5.1 Residential

3.5.2 Commercial

3.6 Global Ceramic Tiles Market Size and Share Outlook by Region, 2024- 2034

4. Asia Pacific Ceramic Tiles Market Value, Market Share and Forecast to 2034

4.1 Asia Pacific Ceramic Tiles Market Overview, 2024

4.2 Asia Pacific Ceramic Tiles Market Revenue and Forecast, 2024- 2034 (US$ Million)

4.3 Asia Pacific Ceramic Tiles Market Size and Share Outlook By Product, 2024- 2034

4.4 Asia Pacific Ceramic Tiles Market Size and Share Outlook By Application, 2024- 2034

4.5 Asia Pacific Ceramic Tiles Market Size and Share Outlook By End Use, 2024- 2034

4.6 Asia Pacific Ceramic Tiles Market Size and Share Outlook by Country, 2024- 2034

4.7 Key Companies in Asia Pacific Ceramic Tiles Market

5. Europe Ceramic Tiles Market Value, Market Share, and Forecast to 2034

5.1 Europe Ceramic Tiles Market Overview, 2024

5.2 Europe Ceramic Tiles Market Revenue and Forecast, 2024- 2034 (US$ Million)

5.3 Europe Ceramic Tiles Market Size and Share Outlook By Product, 2024- 2034

5.4 Europe Ceramic Tiles Market Size and Share Outlook By Application, 2024- 2034

5.5 Europe Ceramic Tiles Market Size and Share Outlook By End Use, 2024- 2034

5.6 Europe Ceramic Tiles Market Size and Share Outlook by Country, 2024- 2034

5.7 Key Companies in Europe Ceramic Tiles Market

6. North America Ceramic Tiles Market Value, Market Share and Forecast to 2034

6.1 North America Ceramic Tiles Market Overview, 2024

6.2 North America Ceramic Tiles Market Revenue and Forecast, 2024- 2034 (US$ Million)

6.3 North America Ceramic Tiles Market Size and Share Outlook By Product, 2024- 2034

6.4 North America Ceramic Tiles Market Size and Share Outlook By Application, 2024- 2034

6.5 North America Ceramic Tiles Market Size and Share Outlook By End Use, 2024- 2034

6.6 North America Ceramic Tiles Market Size and Share Outlook by Country, 2024- 2034

6.7 Key Companies in North America Ceramic Tiles Market

7. South and Central America Ceramic Tiles Market Value, Market Share and Forecast to 2034

7.1 South and Central America Ceramic Tiles Market Overview, 2024

7.2 South and Central America Ceramic Tiles Market Revenue and Forecast, 2024- 2034 (US$ Million)

7.3 South and Central America Ceramic Tiles Market Size and Share Outlook By Product, 2024- 2034

7.4 South and Central America Ceramic Tiles Market Size and Share Outlook By Application, 2024- 2034

7.5 South and Central America Ceramic Tiles Market Size and Share Outlook By End Use, 2024- 2034

7.8 South and Central America Ceramic Tiles Market Size and Share Outlook by Country, 2024- 2034

7.9 Key Companies in South and Central America Ceramic Tiles Market

8. Middle East Africa Ceramic Tiles Market Value, Market Share and Forecast to 2034

8.1 Middle East Africa Ceramic Tiles Market Overview, 2024

8.2 Middle East and Africa Ceramic Tiles Market Revenue and Forecast, 2024- 2034 (US$ Million)

8.3 Middle East Africa Ceramic Tiles Market Size and Share Outlook By Product, 2024- 2034

8.4 Middle East Africa Ceramic Tiles Market Size and Share Outlook By Application, 2024- 2034

8.5 Middle East Africa Ceramic Tiles Market Size and Share Outlook By End Use, 2024- 2034

8.6 Middle East Africa Ceramic Tiles Market Size and Share Outlook by Country, 2024- 2034

8.7 Key Companies in Middle East Africa Ceramic Tiles Market

9. Ceramic Tiles Market Structure

9.1 Key Players

9.2 Ceramic Tiles Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Ceramic Tiles Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Ceramic Tiles Market is estimated to reach USD 243.2 billion by 2032.

The Global Ceramic Tiles Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.8% during the forecast period from 2025 to 2032.

The Global Ceramic Tiles Market is estimated to generate USD 195 billion in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!