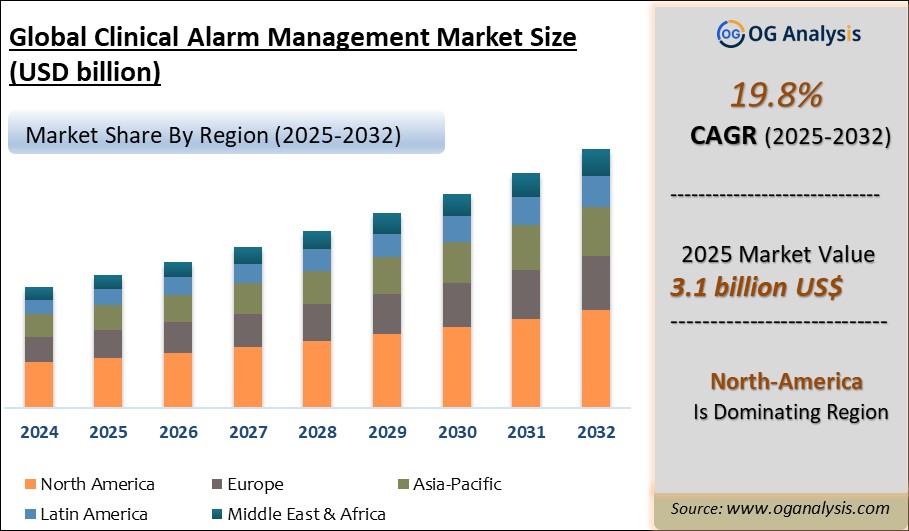

"The Global Clinical Alarm Management Market Size was valued at USD 2.6 billion in 2024 and is projected to reach USD 3.1 billion in 2025. Worldwide sales of Clinical Alarm Management are expected to grow at a significant CAGR of 19.8%, reaching USD 16.2 billion by the end of the forecast period in 2034."

Clinical Alarm Management Market Overview

ChatGPT said:

The Clinical Alarm Management Market is gaining traction as healthcare providers work to mitigate alarm fatigue while enhancing patient safety and care quality. Clinical alarm systems—including cardiac monitors, infusion pumps, ventilators, and telemetry units—generate vast numbers of alerts. Without effective filtering and response protocols, critical notifications can be lost in noise, leading to delayed interventions, increased workload, and compromised patient outcomes. Hospitals and long-term care facilities are investing in comprehensive alarm management platforms that filter and prioritize alarms, integrate with clinical workflows and electronic health records, and provide centralized visibility to reduce nuisance alerts and improve clinical response.

Adoption is supported by growing awareness of alarm-related sentinel events, regulatory guidance, and standards emphasizing alarm system safety. Key stakeholders—combining clinical engineers, IT departments, and frontline clinicians—are deploying smart alarm strategies, including alarm customization, default setting adjustments, and regular review protocols. Solutions offering analytics-driven performance tracking, trend monitoring, and remote alarm notification empower teams to refine system configurations, reduce non-actionable alerts, and optimize workflows. Hospitals increasingly view alarm management as integral to clinical quality, risk reduction, and patient and caregiver experience, driving ongoing growth in intelligent alarm solutions designed for dynamic healthcare environments.

Key Insights

-

Alarm prioritization systems classify alerts by severity and clinical relevance, enabling care teams to address life-threatening conditions while suppressing lower-priority notifications to reduce cognitive overload.

-

Closed-loop escalation workflows route alarms to the right caregiver—via mobile devices or central stations—ensuring timely response and reducing alarm response latency in high-acuity care areas.

-

Advanced analytics help track alarm frequency, duration, and response patterns, supporting quality improvement initiatives, alarm setting optimization, and metric-driven performance reviews.

-

Integration with electronic health records and nurse call systems enables contextualized alarm alerts by linking patient data, history, and care plans, improving actionable insight accuracy.

-

Configurable alarm thresholds and adaptive algorithms adjust alert settings based on unit type or patient risk profile—e.g., ICU vs. med-surg—to balance sensitivity with alarm relevance.

-

Workflow-integrated alarm dashboards provide unified, real-time views across devices and units, aiding situational awareness in decentralized clinical environments and reducing fragmentation.

-

Scheduled alarm reviews and cross-disciplinary committees support continuous refinement of settings, ensuring alarm parameters remain aligned with evolving patient population and care standards.

-

Education modules and alerts training help staff understand alarm logic, settings configuration, and response protocols, fostering alarm literacy and consistent best practices.

-

Regulatory and accreditation adherence—including IEC 60601-1-8 and The Joint Commission standards—incentivizes investment in system alerts and governance processes to reduce alarm-related safety incidents.

-

Vendor offerings now include remote alarm management services, subscription-based software updates, and predictive maintenance to ensure alarm system availability, accuracy, and compliance long-term.

Major Players in the Clinical Alarm Management Market

1. Koninklijke Philips N.V.

2. Ascom Holding AG

3. GE Healthcare

4. Drägerwerk AG & Co. KGaA

5. Spok Inc.

6. Vocera Communications

7. Connexall

8. Capsule Technologies, Inc.

9. Mobile Heartbeat (HCA Healthcare)

10. Masimo Corporation

11. Bernoulli Enterprise, Inc.

12. Mindray Medical International Limited

13. Medtronic PLC

14. Baxter International Inc.

15. Nihon Kohden Corporation

Report Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Component,By End User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analysed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Component:

Software

Hardware

Services

By End User:

Hospitals

Ambulatory Surgical Centers

Long-term Care Centers

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Recent Developments

-

July 2025 – Philips Healthcare launched an AI-driven clinical alarm management system that prioritizes alerts based on patient risk, reducing alarm fatigue among medical staff.

-

June 2025 – Masimo introduced integrated alarm management solutions for its patient monitoring devices, enabling customizable alarm thresholds and enhanced clinical workflow integration.

-

May 2025 – Spacelabs Healthcare expanded its alarm management software with advanced analytics to identify false alarms and optimize alert settings in critical care units.

-

April 2025 – Hospitals increased investments in clinical alarm management platforms to improve patient safety and regulatory compliance amid growing concerns over alarm-related incidents.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Clinical Alarm Management Market is estimated to generate USD 2.6 billion in revenue in 2024.

The Global Clinical Alarm Management Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.8% during the forecast period from 2025 to 2032.

The Clinical Alarm Management Market is estimated to reach USD 11 billion by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!