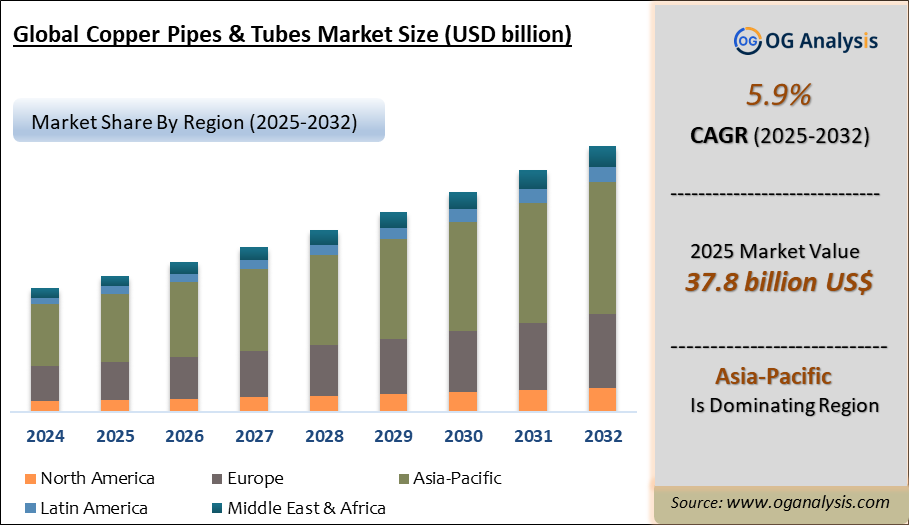

"The Global Copper Pipes and Tubes Market is valued at USD 36.0 billion in 2024 and is projected to reach USD 37.8 billion in 2025. Worldwide sales of Copper Pipes and Tubes are expected to grow at a significant CAGR of 5.9%, reaching USD 64.5 billion by the end of the forecast period in 2034."

"Rising Demand for Energy Efficiency and Sustainable Infrastructure Propels Copper Pipes and Tubes Market Growth in 2024 and Beyond"

The global copper pipes and tubes market is experiencing steady growth, driven by their essential role in various industries such as plumbing, HVAC, refrigeration, and electrical systems. Copper is highly valued for its excellent conductivity, corrosion resistance, and durability, making it the preferred material for pipes and tubes in numerous applications. With increasing urbanization, the demand for copper pipes in residential, commercial, and industrial infrastructure is rising. Copper’s ability to resist corrosion and its long lifespan make it an ideal choice for construction and plumbing systems. Additionally, copper pipes and tubes are integral to energy-efficient applications such as renewable energy systems and advanced refrigeration technologies. The market is also being influenced by innovations, including the development of copper alloys for specialized applications like marine environments and desalination plants. Copper’s recyclability and the growing emphasis on sustainability further contribute to the market’s expansion. Regions such as North America, Europe, and Asia-Pacific are witnessing strong growth in the market, supported by investments in infrastructure development and the need for more energy-efficient systems. The ongoing demand for copper pipes and tubes in heating, ventilation, and air conditioning (HVAC) systems, coupled with advancements in manufacturing processes, continues to drive the market forward, with an increasing shift towards high-quality, durable solutions.

The copper pipes and tubes market is projected to experience a substantial growth rate due to the rising demand for copper in renewable energy systems, plumbing, and refrigeration. The need for copper in electric vehicles (EVs) and energy-efficient solutions, such as solar and geothermal systems, is also expected to fuel market growth. Copper’s excellent thermal and electrical conductivity make it essential in many of today’s most advanced systems, including electric grids and renewable energy infrastructure. The market’s growth is also supported by innovations in manufacturing processes that improve the efficiency and performance of copper pipes, making them more cost-effective for a wider range of applications. As urbanization continues and demand for sustainable, energy-efficient infrastructure grows, the market for copper pipes and tubes will continue to expand, with new applications and demand drivers emerging, particularly in emerging economies. Major players in the market are focusing on expanding their product portfolios to cater to specific needs, such as the development of eco-friendly, low-emission products, as well as higher-grade copper pipes and tubes for specialized industries. Furthermore, sustainability and recycling initiatives are promoting copper’s usage, as the material can be easily recycled and reused, supporting the shift towards a more circular economy in construction and infrastructure.

By end-user, HVAC is the largest segment in the copper pipes and tubes market. The growing demand for energy-efficient heating, ventilation, and air conditioning (HVAC) systems, especially in residential and commercial buildings, is driving the need for copper pipes. Copper’s excellent thermal conductivity and durability make it ideal for HVAC applications, ensuring long-lasting and reliable systems.

By finish type, straight length is the largest segment in the copper pipes and tubes market. Straight-length copper pipes are widely used in plumbing, HVAC, and industrial applications due to their simplicity, versatility, and ease of installation. These pipes are in high demand because they are cost-effective, widely available, and suitable for a variety of applications.

Copper Pipes and Tubes Market- Latest Trends, Drivers, Challenges

-

The global copper pipes and tubes market is projected to grow at a steady pace, driven by the increasing demand for copper in industries such as plumbing, HVAC, and refrigeration. Copper’s excellent conductivity, corrosion resistance, and recyclability contribute to its widespread use in various applications.

-

The demand for copper pipes and tubes is growing in renewable energy applications, such as solar and geothermal systems. Copper’s efficiency in energy transfer makes it a vital component in energy-efficient technologies, which are gaining popularity worldwide due to increasing environmental awareness.

-

Copper pipes and tubes dominate the market due to their long-lasting performance, particularly in plumbing and construction applications. The material’s resistance to corrosion and rust makes it a preferred choice for both residential and commercial infrastructures, ensuring longevity and reliability in water and gas systems.

-

Welded copper pipes are expected to maintain a significant market share, owing to their cost-effectiveness and wide applicability. They are commonly used in HVAC systems, plumbing, and refrigeration, where durability and easy installation are essential.

-

The growing demand for electric vehicles (EVs) is contributing to the increased use of copper pipes and tubes in automotive cooling systems. Copper is integral to the thermal management of electric vehicle batteries, making it a crucial material in the EV market.

-

Asia-Pacific is the fastest-growing region in the copper pipes and tubes market, driven by rapid urbanization, infrastructure development, and rising disposable incomes. Countries like China and India are expanding their construction and manufacturing sectors, fueling demand for copper-based solutions.

-

North America and Europe continue to drive market growth, particularly in the HVAC and plumbing sectors, where copper pipes and tubes are essential for energy-efficient systems. The focus on sustainability and infrastructure modernization in these regions is also promoting the adoption of copper-based solutions.

-

Copper alloys, such as cupro-nickel, are becoming increasingly popular for specialized applications like marine environments and desalination plants. These alloys offer enhanced corrosion resistance, making them ideal for harsh environments where standard copper may not be suitable.

-

The increasing preference for eco-friendly and sustainable building materials is benefiting the copper pipes and tubes market. Copper’s recyclability and low environmental impact support its role in the growing demand for green building initiatives and sustainable infrastructure development.

-

Manufacturers in the copper pipes and tubes market are focusing on improving the efficiency and cost-effectiveness of production processes. Innovations in manufacturing technologies, such as advanced extrusion techniques, are leading to better quality copper products and reduced costs, enhancing market competitiveness.

Competitive Landscape and Key Strategies

The Copper Pipes and Tubes Market is highly competitive, with both global and regional players striving to maintain and expand their market share. Key companies are focusing on innovation and sustainability to meet the growing demand for eco-friendly and energy-efficient solutions. One of the major strategies employed by top companies is investing in research and development to improve product performance, particularly in terms of durability, corrosion resistance, and thermal conductivity. Many companies are also exploring advanced manufacturing techniques, such as precision extrusion and thin-wall tubing, to reduce material usage and production costs.

Sustainability is another key focus area, with leading companies adopting recycling initiatives and green manufacturing practices to reduce their carbon footprint. Partnerships with construction firms, automotive manufacturers, and renewable energy companies are also common, enabling copper producers to expand their reach in high-growth industries. Additionally, companies are leveraging digital technologies to enhance customer service, streamline supply chains, and improve product delivery. By implementing these strategies, top players in the copper pipes and tubes market are positioning themselves for long-term growth in an increasingly competitive landscape.

Market Players

Key companies operating in the Copper Pipes and Tubes Market include:

1. Mueller Industries, Inc.

2. Wieland-Werke AG

3. KME Group S.p.A.

4. Cerro Flow Products LLC

5. MetTube International LLC

6. Hailiang Group Co., Ltd.

7. Kobelco & Materials Copper Tube, Ltd.

8. Furukawa Electric Co., Ltd.

9. Luvata Group

10. Golden Dragon Precise Copper Tube Group Inc.

11. Shanghai Metal Corporation

12. Cambridge-Lee Industries LLC

13. Mehta Tubes Limited

14. Foshan Huahong Copper Tube Co., Ltd.

15. Qingdao Hongtai Metal Co., Ltd.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By End-User, By Dimension, By Finish Type |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analysed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By End-user

- HVAC

- Industrial heat exchange

- Plumbing

- Electrical

- Others

By Dimension

- Type K

- Type L

- Type M

- Others

By Finish Type

- LWC Grooved

- Straight Length

- Pancake

- LWC Plain

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

-

In July 2025, a leading copper pipe manufacturer announced a significant investment in expanding its production capacity to meet the growing demand in the HVAC and plumbing sectors, focusing on eco-friendly manufacturing processes to align with global sustainability goals.

-

In June 2025, a prominent European company introduced a new line of copper pipes with enhanced corrosion resistance for use in desalination plants and marine applications, aimed at addressing the increasing demand for high-performance materials in harsh environments.

-

In April 2025, a major North American copper pipe supplier launched a new range of low-emission, energy-efficient copper pipes designed to meet the growing demand for sustainable building materials in the green construction sector.

-

In March 2025, a global supplier of copper tubes announced a partnership with a leading electric vehicle manufacturer to provide copper components for the automotive industry's thermal management systems, emphasizing the growing use of copper in electric vehicle cooling solutions.

-

In December 2024, a leading copper pipe manufacturer expanded its distribution network in the Asia-Pacific region, responding to the rising demand for copper products driven by rapid urbanization and infrastructure development in countries like China and India.

-

In November 2024, a major player in the copper tube industry launched a new copper alloy product line designed for industrial heat exchange applications, promising higher durability and efficiency in extreme temperature environments.

-

In September 2024, a top copper pipe producer unveiled a new manufacturing process that increases the production speed of straight-length copper pipes, reducing costs and improving supply chain efficiency to meet the demand in plumbing and HVAC markets.

-

In August 2024, a key European copper pipe manufacturer announced plans to develop a new copper tube designed specifically for geothermal energy applications, responding to the growing demand for sustainable energy solutions.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Copper Pipes and Tubes Market is estimated to generate USD 36 billion in revenue in 2024.

The Global Copper Pipes and Tubes Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period from 2025 to 2032.

The Copper Pipes and Tubes Market is estimated to reach USD 56.9 billion by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!