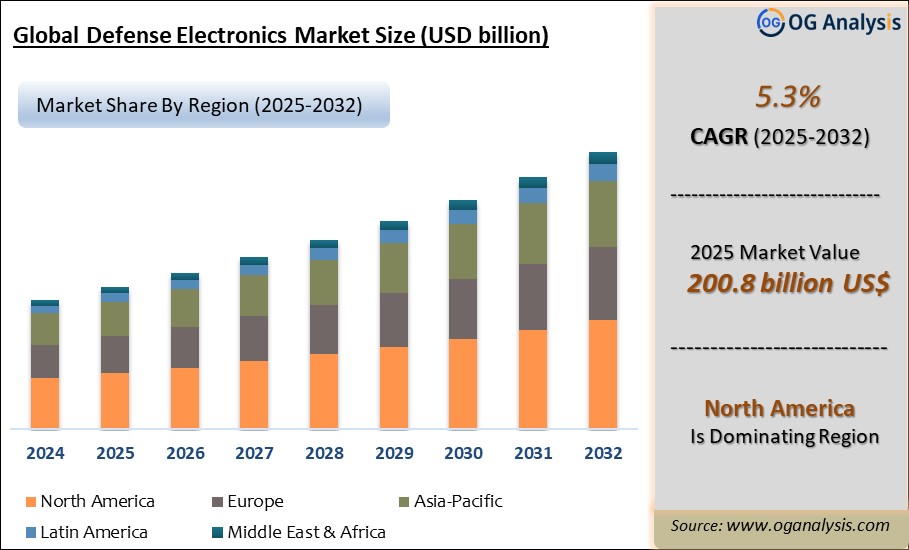

"The Global Defense Electronics Market Size was valued at USD 192.0 billion in 2024 and is projected to reach USD 200.8 billion in 2025. Worldwide sales of Defense Electronics are expected to grow at a significant CAGR of 5.3%, reaching USD 325.3 billion by the end of the forecast period in 2034."

Defense Electronics Market Report Description

The Defense Electronics Market is experiencing significant growth as military forces around the world focus on modernizing operational capabilities with advanced electronic systems. These systems include radar and surveillance, electronic warfare, communications, navigation, and command-and-control platforms. As geopolitical uncertainties rise and defense budgets grow, defense electronics providers innovate to deliver systems that are more compact, modular, secure, and interoperable across air, land, sea, and space domains. The shift toward network-centric warfare and integrated defense architectures has elevated demand for real-time data fusion, hardened communications, and precision-targeting systems. At the same time, constraints on weight, power consumption, and bandwidth are driving technological advancements in miniaturization, embedded AI, and secure open-architecture designs.

In parallel, the industry is seeing close collaboration among governments, primes, and specialized technology providers to co-develop secure, upgradable electronics. Defense suppliers are integrating COTS (commercial off-the-shelf) technologies into ruggedized, military-grade frameworks to balance performance, cost, and lifecycle management. Remote-based maintenance, predictive diagnostics, and modular hardware swaps are becoming standard—ensuring fielded systems remain mission-ready with minimal downtime. While certification timelines, cybersecurity threats, and component supply chain restrictions pose challenges, industry leaders are investing in secure fabrication, supply resilience, and AI-driven design tools. Looking ahead, opportunities lie in next-generation sensors, software-defined radios, directed-energy control systems, and integrated electronic warfare suites as defense forces embrace digital transformation and multi-domain synergy.

Defense Electronics Market: Key Insights

-

Advanced radar and sensing systems featuring AESA arrays, low-observable T/R modules, and onboard signal processing are enhancing detection, tracking, and targeting while reducing size, weight, and power demands across air, naval, and ground platforms.

-

Electronic warfare platforms are incorporating agile RF front ends, digital receiver-transmitters, and machine learning algorithms to enable adaptive jamming, threat detection, and countermeasures in contested electromagnetic environments.

-

Secure, software-defined radios with modular waveforms support multi-band communications, anti-jam resilience, and tactical data sharing across distributed assets, promoting real-time situational awareness and interoperability in coalition operations.

-

Embedded AI and edge-processing capabilities are being integrated into onboard navigation and sensor systems to handle data in real time, enabling autonomous targeting, anomaly detection, and predictive maintenance.

-

Ruggedized COTS electronics—with MIL-spec packaging, shock- and thermal-hardening—are being used to balance cost and upgradeability while maintaining military-grade resilience and rapid field modernization.

-

Electronic warfare, radar, and communication packages are being designed as modular open-standard systems, enabling plug-and-play upgrades and integration with existing platforms for extended mission adaptability.

-

Predictive diagnostics and remote health management systems allow for proactive maintenance of deployed systems, reducing logistical footprints and ensuring readiness in forward operating environments.

-

Supply chain resilience initiatives—including secure microchip fabrication, dual-sourcing strategies, and trusted vendor programs—are being implemented to mitigate high-risk obsolescence and geopolitical disruptions.

-

Directed-energy electronic control modules (e.g., for laser-based defense systems) are becoming more reliable and compact, positioning electronics as key enablers for scalable, next-gen weapon applications.

-

Cyber-hardened architectures, secure boot processes, and encrypted data pathways are priorities as all defense electronics integrate against cyber intrusion, spoofing, and data manipulation threats during operation.

Major Players in the Defense Electronics Market

1. Lockheed Martin Corporation

2. Northrop Grumman Corporation

3. Raytheon Technologies Corporation

4. BAE Systems plc

5. Thales Group

6. General Dynamics Corporation

7. L3Harris Technologies, Inc.

8. Leonardo S.p.A.

9. Elbit Systems Ltd.

10. Saab AB

11. Honeywell International Inc.

12. FLIR Systems, Inc.

13. Rheinmetall AG

14. Cobham plc

15. Teledyne Technologies Incorporated

Report Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD Billion |

| Market Splits Covered | By Product Type, By Application, and By End User |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

By Product Type:

- Radar Systems

- Communication Systems

- Electronic Warfare Equipment

- Infrared Systems

- Electro-Optical Systems

- Others

By Application:

- Airborne

- Naval

- Ground

By End User:

- Military

- Homeland Security

By Region:

- North America

- Europe - Asia-Pacific

- Latin America

- Middle East & Africa

Recent Developments

-

July 2025 – Lockheed Martin unveiled its next-generation electronic warfare suite for military aircraft, enhancing detection and countermeasure capabilities against advanced threats.

-

June 2025 – BAE Systems secured a major contract to supply integrated defense electronics for NATO ground vehicles, focusing on situational awareness and cyber protection.

-

May 2025 – Raytheon Technologies expanded its production of ruggedized communication and sensor systems to meet rising demand for secure battlefield connectivity.

-

April 2025 – Northrop Grumman launched an upgraded radar system designed for air and missile defense, offering higher resolution and improved threat tracking for defense forces.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Defense Electronics Market is estimated to generate USD 192 billion in revenue in 2024.

The Global Defense Electronics Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period from 2025 to 2032.

The Defense Electronics Market is estimated to reach USD 290.2 billion by 2032.

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!