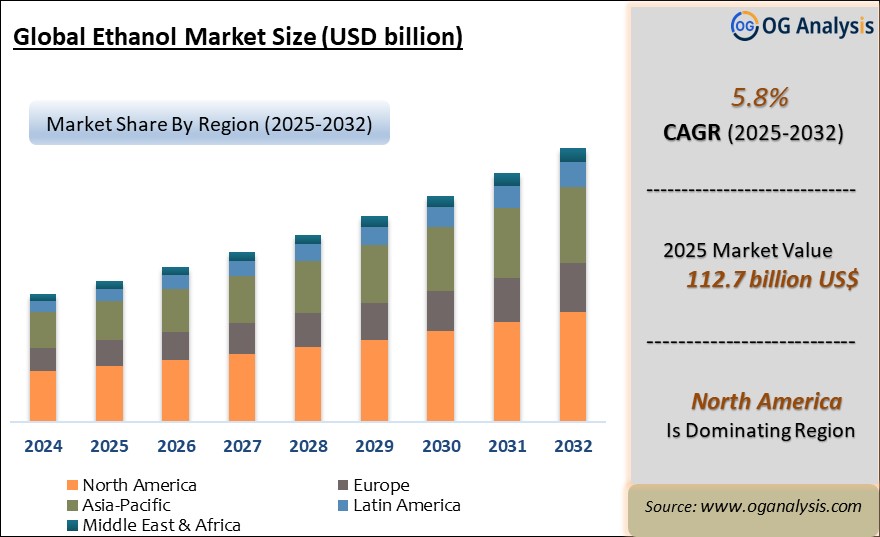

"The Global Ethanol Market Size was valued at USD 107.3 billion in 2024 and is projected to reach USD 112.7 billion in 2025. Worldwide sales of Ethanol are expected to grow at a significant CAGR of 5.8%, reaching USD 190.6 billion by the end of the forecast period in 2034."

Ethanol Market Introduction and Overview

The ethanol market plays a critical role in the global energy, beverage, and industrial sectors. Ethanol, a renewable biofuel primarily derived from biomass such as corn and sugarcane, has gained widespread acceptance due to its environmental benefits and versatility. It is commonly used as a gasoline additive to reduce greenhouse gas emissions and increase octane levels. Additionally, ethanol finds applications in the beverage industry as the primary component of alcoholic drinks and serves as a solvent in pharmaceutical and industrial processes. Over the years, government policies aimed at promoting cleaner fuels and reducing dependency on fossil fuels have been major catalysts for the growth of the ethanol market. Emerging economies in regions like Latin America and Asia-Pacific are also contributing to the rising demand for ethanol in diverse industries.

The global ethanol market is segmented based on feedstock, application, and region. Key players in the market continue to innovate and adopt sustainable production processes to meet the increasing demand. North America, led by the U.S., is one of the largest producers of ethanol, benefiting from strong agricultural outputs, particularly corn. Meanwhile, Brazil leads in sugarcane-based ethanol production. Market growth is also supported by expanding usage in sectors such as pharmaceuticals, personal care, and food & beverages. Despite challenges such as fluctuating raw material prices and regulatory hurdles, the ethanol market remains on a growth trajectory, driven by the rising global shift towards cleaner energy sources.

Latest Trends in the Ethanol Market

Several trends are currently shaping the ethanol market, particularly the focus on advanced biofuels. First-generation ethanol, primarily produced from food crops, is being gradually complemented by second-generation ethanol made from lignocellulosic materials such as agricultural residues and waste products. This shift addresses concerns over food security and environmental sustainability. Another trend is the growing adoption of ethanol in the aviation sector as a sustainable aviation fuel (SAF) to reduce the carbon footprint of air travel. Technological advancements in ethanol production methods, such as enzymatic hydrolysis and gasification, are also driving efficiency gains in the industry.

In addition to technological shifts, regulatory policies are significantly influencing the ethanol market. Government mandates like the U.S. Renewable Fuel Standard (RFS) and the European Union„¢s Renewable Energy Directive (RED) are pushing for higher biofuel blends in transportation fuels. In markets like India, blending targets of up to 20% ethanol in gasoline by 2025 have been set, creating significant demand opportunities. Electric vehicles (EVs), often seen as competition to ethanol-based fuels, are now being viewed as complementary rather than substitutes, as hybrid models utilizing both ethanol and electricity gain traction.

Lastly, the ethanol market is witnessing a rising demand for ethanol-based products in the personal care and pharmaceutical sectors. Ethanol„¢s role as a disinfectant has gained prominence during the COVID-19 pandemic, where hand sanitizers and cleaning agents saw a surge in consumption. In the food and beverage industry, ethanol„¢s demand remains steady, particularly in alcoholic beverages, where it serves as the fundamental ingredient. This diversification of end-use applications is buffering the market against fluctuations in fuel demand.

Drivers of the Ethanol Market

The ethanol market is primarily driven by the growing global demand for cleaner energy and the shift towards sustainable fuel alternatives. Governments around the world are prioritizing biofuels to reduce carbon emissions and decrease dependence on fossil fuels, creating a supportive regulatory environment for ethanol. In the United States, the Renewable Fuel Standard mandates ethanol blending in gasoline, which continues to boost domestic production. Similarly, Brazil„¢s Proálcool program encourages ethanol production from sugarcane, positioning the country as a global leader in the ethanol industry.

Another major driver is the increasing demand for ethanol in the automotive sector. Ethanol-blended fuels, such as E10 and E15, help lower the environmental impact of gasoline, making it an attractive option for governments seeking to meet emissions reduction targets. Additionally, ethanol is viewed as a viable fuel for flex-fuel vehicles (FFVs), which can run on higher ethanol blends like E85. The growing adoption of FFVs in key markets such as the U.S., Brazil, and parts of Europe is further fueling ethanol consumption.

Rising consumer awareness regarding the environmental impact of energy choices is another factor bolstering the ethanol market. With an increasing focus on green energy, industries are leaning towards renewable and biodegradable alternatives. Ethanol, derived from renewable sources, fits this trend and is thus gaining traction in multiple sectors, from transportation to pharmaceuticals and personal care. The transition to a circular economy and greater corporate social responsibility (CSR) initiatives are also fostering the adoption of biofuels like ethanol.

Challenges in the Ethanol Market

Despite its growth potential, the ethanol market faces several challenges. One of the primary concerns is the fluctuating availability and cost of feedstocks such as corn and sugarcane, which significantly impact production costs. Climate change and unpredictable weather patterns can lead to poor harvests, reducing feedstock availability and driving up prices. This volatility can deter investments and create supply chain uncertainties, especially for small and medium-sized ethanol producers.

Additionally, the food versus fuel debate remains a significant challenge, particularly for first-generation ethanol production. As food crops like corn are diverted towards fuel production, concerns over food security and price inflation arise, particularly in developing economies. Governments are increasingly scrutinizing the impact of ethanol production on food supply chains, which could lead to stricter regulations or a push for more sustainable feedstock sources, such as waste biomass.

The growing competition from alternative energy sources, such as electric vehicles and hydrogen, also poses a long-term challenge to the ethanol market. While ethanol blends may continue to be relevant in the near future, the increasing adoption of electric vehicles, backed by global initiatives to phase out internal combustion engines, could reduce the overall demand for ethanol-based fuels in the coming decades.

Market Players

Archer Daniels Midland Company

POET LLC

Valero Energy Corporation

Green Plains Inc.

Flint Hills Resources

Pacific Ethanol, Inc.

Cargill, Incorporated

The Andersons Inc.

RaÃÂzen S.A.

Royal Dutch Shell plc

BP plc

Praj Industries Ltd.

Abengoa Bioenergy S.A.

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Source, By Raw Material, By Fuel Blend and By Application |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

By Source

- Natural Source

- Synthetic Source

By Raw Material

- Starch based

- Cellulose-based

- Algae

- Industrial Waste

- Petrochemicals

By Fuel Blend

- E5

- E10

- E15 to E70

- E75 & E85

- Others

By Application

- Transportation

- Alcoholic Beverages

- Power Generation

- Pharmaceuticals

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Ethanol Market Latest Trends, Drivers and Challenges, 2024- 2032

2.1 Ethanol Market Overview

2.2 Key Strategies of Leading Ethanol Companies

2.3 Ethanol Market Insights, 2024- 2032

2.3.1 Leading Ethanol Types, 2024- 2032

2.3.2 Leading Ethanol End-User industries, 2024- 2032

2.3.3 Fast-Growing countries for Ethanol sales, 2024- 2032

2.4 Ethanol Market Drivers and Restraints

2.4.1 Ethanol Demand Drivers to 2032

2.4.2 Ethanol Challenges to 2032

2.5 Ethanol Market- Five Forces Analysis

2.5.1 Ethanol Industry Attractiveness Index, 2024

2.5.2 Threat of New Entrants

2.5.3 Bargaining Power of Suppliers

2.5.4 Bargaining Power of Buyers

2.5.5 Intensity of Competitive Rivalry

2.5.6 Threat of Substitutes

3. Global Ethanol Market Value, Market Share, and Forecast to 2032

3.1 Global Ethanol Market Overview, 2024

3.2 Global Ethanol Market Revenue and Forecast, 2024- 2032 (US$ Million)

3.3 Global Ethanol Market Size and Share Outlook By Source, 2024- 2032

3.3.1 Natural Source

3.3.2 Synthetic Source

3.4 Global Ethanol Market Size and Share Outlook By Raw Material, 2024- 2032

3.4.1 Starch based

3.4.2 Cellulose-based

3.4.3 Algae

3.4.4 Industrial Waste

3.4.5 Petrochemicals

3.5 Global Ethanol Market Size and Share Outlook By Fuel Blend, 2024- 2032

3.5.1 E5

3.5.2 E10

3.5.3 E15 to E70

3.5.4 E75 & E85

3.5.5 Others

3.6 Global Ethanol Market Size and Share Outlook By Application, 2024- 2032

3.6.1 Transportation

3.6.2 Alcoholic Beverages

3.6.3 Power Generation

3.6.4 Pharmaceuticals

3.6.5 Others

3.7 Global Ethanol Market Size and Share Outlook by Region, 2024- 2032

4. Asia Pacific Ethanol Market Value, Market Share and Forecast to 2032

4.1 Asia Pacific Ethanol Market Overview, 2024

4.2 Asia Pacific Ethanol Market Revenue and Forecast, 2024- 2032 (US$ Million)

4.3 Asia Pacific Ethanol Market Size and Share Outlook By Source, 2024- 2032

4.4 Asia Pacific Ethanol Market Size and Share Outlook By Raw Material, 2024- 2032

4.5 Asia Pacific Ethanol Market Size and Share Outlook By Fuel Blend, 2024- 2032

4.6 Asia Pacific Ethanol Market Size and Share Outlook By Application, 2024- 2032

4.7 Asia Pacific Ethanol Market Size and Share Outlook by Country, 2024- 2032

4.8 Key Companies in Asia Pacific Ethanol Market

5. Europe Ethanol Market Value, Market Share, and Forecast to 2032

5.1 Europe Ethanol Market Overview, 2024

5.2 Europe Ethanol Market Revenue and Forecast, 2024- 2032 (US$ Million)

5.3 Europe Ethanol Market Size and Share Outlook By Source, 2024- 2032

5.4 Europe Ethanol Market Size and Share Outlook By Raw Material, 2024- 2032

5.5 Europe Ethanol Market Size and Share Outlook By Fuel Blend, 2024- 2032

5.6 Europe Ethanol Market Size and Share Outlook By Application, 2024- 2032

5.7 Europe Ethanol Market Size and Share Outlook by Country, 2024- 2032

5.8 Key Companies in Europe Ethanol Market

6. North America Ethanol Market Value, Market Share and Forecast to 2032

6.1 North America Ethanol Market Overview, 2024

6.2 North America Ethanol Market Revenue and Forecast, 2024- 2032 (US$ Million)

6.3 North America Ethanol Market Size and Share Outlook By Source, 2024- 2032

6.4 North America Ethanol Market Size and Share Outlook By Raw Material, 2024- 2032

6.5 North America Ethanol Market Size and Share Outlook By Fuel Blend, 2024- 2032

6.6 North America Ethanol Market Size and Share Outlook By Application, 2024- 2032

6.7 North America Ethanol Market Size and Share Outlook by Country, 2024- 2032

6.8 Key Companies in North America Ethanol Market

7. South and Central America Ethanol Market Value, Market Share and Forecast to 2032

7.1 South and Central America Ethanol Market Overview, 2024

7.2 South and Central America Ethanol Market Revenue and Forecast, 2024- 2032 (US$ Million)

7.3 South and Central America Ethanol Market Size and Share Outlook By Source, 2024- 2032

7.4 South and Central America Ethanol Market Size and Share Outlook By Raw Material, 2024- 2032

7.5 South and Central America Ethanol Market Size and Share Outlook By Fuel Blend, 2024- 2032

7.6 South and Central America Ethanol Market Size and Share Outlook By Application, 2024- 2032

7.7 South and Central America Ethanol Market Size and Share Outlook by Country, 2024- 2032

7.8 Key Companies in South and Central America Ethanol Market

8. Middle East Africa Ethanol Market Value, Market Share and Forecast to 2032

8.1 Middle East Africa Ethanol Market Overview, 2024

8.2 Middle East and Africa Ethanol Market Revenue and Forecast, 2024- 2032 (US$ Million)

8.3 Middle East Africa Ethanol Market Size and Share Outlook By Source, 2024- 2032

8.4 Middle East Africa Ethanol Market Size and Share Outlook By Raw Material, 2024- 2032

8.5 Middle East Africa Ethanol Market Size and Share Outlook By Fuel Blend, 2024- 2032

8.6 Middle East Africa Ethanol Market Size and Share Outlook By Application, 2024- 2032

8.7 Middle East Africa Ethanol Market Size and Share Outlook by Country, 2024- 2032

8.8 Key Companies in Middle East Africa Ethanol Market

9. Ethanol Market Structure

9.1 Key Players

9.2 Ethanol Companies - Key Strategies and Financial Analysis

9.2.1 Snapshot

9.2.3 Business Description

9.2.4 Products and Services

9.2.5 Financial Analysis

10. Ethanol Industry Recent Developments

11 Appendix

11.1 Publisher Expertise

11.2 Research Methodology

11.3 Annual Subscription Plans

11.4 Contact Information

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Ethanol Market is estimated to generate USD 107.3 billion in revenue in 2024.

The Global Ethanol Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2025 to 2032.

The Ethanol Market is estimated to reach USD 168.5 billion by 2032.

$3950- 5%

$6450- 10%

$8450- 15%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!