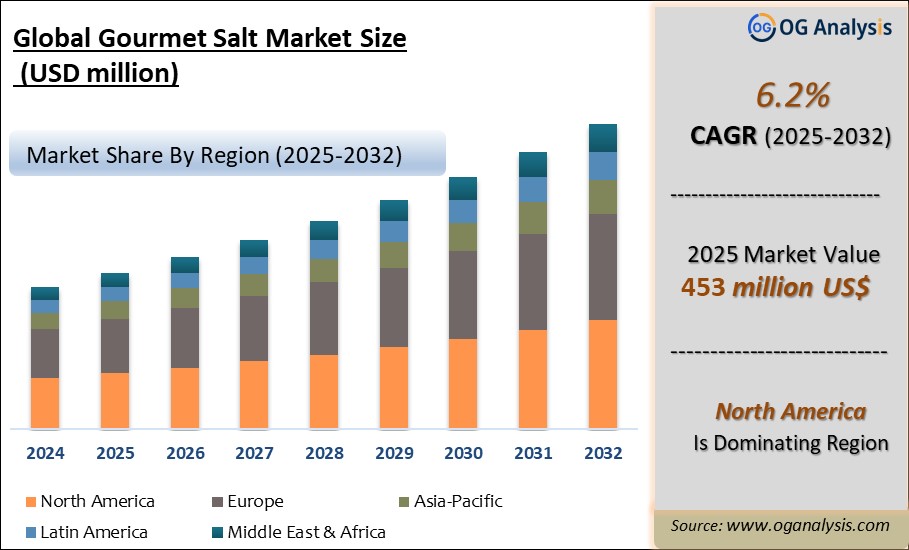

"The Global Gourmet Salt Market Size was valued at USD 430 million in 2024 and is projected to reach USD 453 million in 2025. Worldwide sales of Gourmet Salt are expected to grow at a significant CAGR of 6.2%, reaching USD 791 million by the end of the forecast period in 2034."

Introduction and Overview of the Gourmet Salt Market

The gourmet salt market has witnessed significant growth in recent years, driven by an increasing consumer preference for premium, natural, and minimally processed foods. Gourmet salts are unrefined and naturally sourced, often containing trace minerals that add unique flavor profiles and health benefits. These salts, which include varieties like Himalayan pink salt, fleur de sel, and smoked salts, are being adopted by chefs and food enthusiasts alike. The rising trend of gourmet cuisine and fine dining, both in restaurants and at home, is fueling demand for these specialty salts. This shift aligns with the broader consumer movement towards organic, artisanal, and healthy food products, contributing to the expansion of the gourmet salt market globally.

In addition to the flavor and health benefits, gourmet salts are also perceived as a status symbol in culinary experiences. Consumers are increasingly exploring new flavors and ingredients, inspired by food blogs, cooking shows, and social media platforms. The demand is further boosted by the expanding retail availability of gourmet salts through specialized stores, gourmet food markets, and online platforms. The global gourmet salt market is projected to maintain its upward trajectory, driven by innovations in packaging, product diversification, and increased consumer awareness of high-quality ingredients.

Gourmet Salt Market: Latest , Drivers , and Challenges

One of the most prominent trends in the gourmet salt market is the rise of organic and sustainably sourced products. As consumers become more conscious of their environmental footprint, they are gravitating towards salts harvested using eco-friendly and sustainable methods. This includes hand-harvested sea salts and those sourced from unpolluted waters. Additionally, flavored and infused salts, such as those with herbs, spices, or even edible flowers, are gaining traction as they offer added versatility for culinary experimentation.

Moreover, the growing interest in international and exotic cuisines has also fueled the popularity of gourmet salts. Consumers are seeking out salts with distinct regional characteristics, such as Hawaiian black lava salt or French grey salt, which complement the global fusion food trend. The rise of gourmet food gift sets, often including a variety of premium salts, has also contributed to the market„¢s growth, catering to consumers looking for unique and luxury culinary experiences.

Another emerging trend is the increasing use of gourmet salts in the wellness and beauty industries. Many salts, particularly those rich in minerals like magnesium and potassium, are used in bath salts, scrubs, and other skincare products. This cross-industry demand for gourmet salts is helping to diversify market opportunities and attract a broader range of consumers.

The growing consumer focus on health and wellness is a key driver in the gourmet salt market. Many gourmet salts are touted for their higher mineral content compared to regular table salt, appealing to health-conscious buyers. For instance, Himalayan pink salt is often promoted for its trace minerals, while sea salts are recognized for their lower processing levels. Additionally, the demand for clean-label products, which are free from additives and preservatives, aligns well with the natural and unrefined qualities of gourmet salts.

The rise of social media and digital platforms has also played a significant role in driving the gourmet salt market. Influencers and culinary content creators showcase gourmet salts in their recipes, encouraging home chefs to experiment with these premium products. Moreover, as consumers become more adventurous in their cooking, they are seeking out specialty ingredients to elevate their dishes, driving demand for gourmet salts.

Another driver is the growing premiumization of food and beverage products. As consumers become more willing to spend on high-quality and artisanal food items, gourmet salts have found a place in luxury food categories. The increased availability of gourmet salts through both online and offline channels, coupled with the rising awareness of their unique properties, continues to boost their market presence globally.

Despite the positive market outlook, the gourmet salt industry faces several challenges. One of the primary hurdles is the premium pricing of these salts, which can limit their accessibility to a broader consumer base. While gourmet salts are perceived as superior, they are often significantly more expensive than regular table salt, which may deter price-sensitive consumers. Furthermore, the lack of standardized regulations regarding labeling and product quality can lead to inconsistency in the market, with some consumers questioning the authenticity of certain gourmet salts.

Another challenge is the environmental impact of salt production, particularly for sea salt, which can lead to ecological concerns regarding sustainable harvesting practices. As consumers become more environmentally conscious, companies may face pressure to adopt more transparent and sustainable sourcing methods. Navigating these challenges will be crucial for maintaining consumer trust and driving future growth in the gourmet salt market.

Market Players

Cargill, Inc.

SaltWorks, Inc.

Morton Salt, Inc.

Maldon Salt Company Limited

Murray River Salt

Amagansett Sea Salt Co.

Alaska Pure Sea Salt Co.

Jacobsen Salt Co.

Le Saunier de Camargue

San Francisco Salt Company

Salt Traders

The Savory Pantry

Bitterman Salt Co.

Market Scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD Million |

| Market Splits Covered | By Type, By Application, and By Distribution Channel |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

By Claim

- Organic

- Sodium Free/Low Sodium

- Conventional

By Type

- Sel Gris

- Flakey Salt

- Himalayan Salt

- Fleur de sel

- Specialty Salt

- Others

By Application

- Bakery

- Confectionary

- Meat & Poultry

- Sea Food

- Sauces & Savories

- Others

By Distribution Channel

- Direct

- Retail

- Online

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Gourmet Salt Market is estimated to reach USD 695.8 million by 2032.

The Global Gourmet Salt Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period from 2025 to 2032.

The Global Gourmet Salt Market is estimated to generate USD 430 million in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!