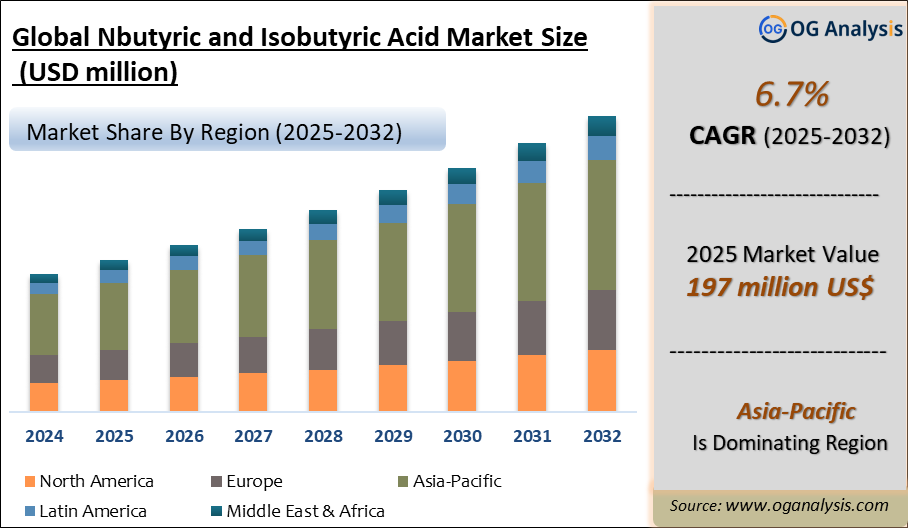

"The Global N-butyric and isobutyric acid Market Size was valued at USD 187 million in 2024 and is projected to reach USD 197 million in 2025. Worldwide sales of N-butyric and isobutyric acid are expected to grow at a significant CAGR of 6.7%, reaching USD 362 million by the end of the forecast period in 2034."

The N-butyric and isobutyric acid market is a dynamic segment within the chemical industry, driven by diverse applications across multiple sectors. N-butyric acid, a short-chain fatty acid with a distinctive odor, is widely utilized in the production of esters, which are used in flavorings, fragrances, and as intermediates in chemical syntheses. Isobutyric acid, with its branched-chain structure, finds applications primarily in the manufacture of polyisobutylene and as a raw material in various chemical processes. Both acids play critical roles in industrial applications, including pharmaceuticals, agriculture, and plastics, reflecting their significant demand and market relevance.

As industries continue to expand and innovate, the demand for N-butyric and isobutyric acids has seen a steady increase. The market is influenced by trends in consumer preferences, regulatory changes, and technological advancements in chemical production. These acids are crucial in sectors such as food and beverage, where they enhance flavor and aroma, and in the automotive industry, where they contribute to the synthesis of high-performance materials. The market's growth is supported by the continual need for specialty chemicals and the development of new applications, making it an area of active investment and research.

Trade Intelligence for N-butyric and isobutyric acid market

| Global Butanoic acids Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 563 | 765 | 873 | 688 | 720 |

| India | 41.4 | 67.0 | 77.4 | 62.7 | 76.4 |

| United States of America | 56.4 | 82.3 | 92.8 | 64.8 | 66.2 |

| Netherlands | 48.7 | 49.7 | 56.8 | 57.3 | 48.4 |

| Singapore | 12.0 | 44.0 | 75.7 | 52.1 | 46.1 |

| Belgium | 30.6 | 34.9 | 43.8 | 37.3 | 40.0 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- India, United States of America, Netherlands, Singapore and Belgium are the top five countries importing 38.5% of global Butanoic acids in 2024

- Global Butanoic acids Imports increased by 27.9% between 2020 and 2024

- India accounts for 10.6% of global Butanoic acids trade in 2024

- United States of America accounts for 9.2% of global Butanoic acids trade in 2024

- Netherlands accounts for 6.7% of global Butanoic acids trade in 2024

| Global Butanoic acids Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Latest Trends

One of the key trends in the N-butyric and isobutyric acid market is the growing emphasis on sustainable and eco-friendly production processes. With increasing environmental concerns, manufacturers are investing in greener technologies that minimize waste and reduce carbon footprints. This shift is driven by both regulatory pressures and consumer demand for environmentally responsible products. Innovations in biotechnological methods and renewable resources are paving the way for more sustainable production, making these acids more attractive to eco-conscious industries.

Another notable trend is the rising demand for N-butyric acid in the pharmaceutical and healthcare sectors. N-butyric acid's potential therapeutic benefits, including its role in supporting gut health and its anti-inflammatory properties, are driving research and development activities. This increased focus on health and wellness is expanding the use of N-butyric acid beyond traditional applications, creating new opportunities for growth within the healthcare and nutraceutical markets.

The use of isobutyric acid in high-performance materials and polymers is also on the rise. Advances in polymer chemistry are enhancing the performance characteristics of materials derived from isobutyric acid, such as improved durability and resistance properties. This trend is particularly evident in the automotive and aerospace industries, where there is a constant demand for materials that offer superior performance and reliability. As these industries continue to evolve, the role of isobutyric acid in developing cutting-edge materials is becoming increasingly significant.

Drivers

Several factors are driving the growth of the N-butyric and isobutyric acid market. Firstly, the expanding food and beverage industry is a major driver, as these acids are used in flavorings and fragrances to enhance product appeal. The increasing consumption of processed foods and beverages, coupled with rising consumer preferences for natural and diverse flavors, fuels the demand for these acids. Additionally, the development of new food products and formulations that incorporate N-butyric and isobutyric acids further supports market growth.

Another significant driver is the ongoing advancement in chemical manufacturing technologies. Improvements in production efficiency and cost-effectiveness are making it easier for manufacturers to meet growing demand and explore new applications for these acids. Technological innovations, such as the development of catalysts and optimized reaction conditions, are enhancing the scalability and economic viability of producing N-butyric and isobutyric acids, thus contributing to market expansion.

The increasing focus on health and wellness is also boosting the demand for N-butyric acid in the nutraceutical and pharmaceutical industries. Research highlighting its potential health benefits, such as improving gut health and acting as an anti-inflammatory agent, is driving interest and investment in this sector. The expanding use of N-butyric acid in dietary supplements and therapeutic products reflects the broader trend of incorporating beneficial compounds into health-focused formulations.

Market Challenges

Despite the positive outlook for the N-butyric and isobutyric acid market, several challenges need to be addressed. One of the primary issues is the volatility in raw material prices, which can impact production costs and profit margins. Fluctuations in the availability and cost of feedstocks, such as petrochemical derivatives, can create uncertainty for manufacturers and affect market stability. Additionally, the need for continuous investment in research and development to keep pace with technological advancements and regulatory requirements can be a significant financial burden for companies operating in this sector. Addressing these challenges requires strategic planning and adaptation to ensure sustained growth and competitiveness in the market.

Market Players

1. Beijing Huamaoyuan Fragrance Flavor Co., Ltd.

2. Blue Marble Biomaterials

3. Eastman Chemical Company

4. Flavor Co., ltd., Inc.

5. Merck KGaA

6. OQ Chemicals GmbH

7. OXEA GmbH

8. Perstorp Holding AB

9. Shanghai Kayi Chemical Co., Ltd.

10. Snowco industrial Co., Ltd.

11. Thermo Fisher Scientific

12. Tokyo Chemical Industry Co., Ltd

Report Scope

| Parameter | N-butyric and isobutyric acid Market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD million |

| Market Splits Covered | By Product, By Type, By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

- By Product

- n-butyric acid

- isobutyric acid

- By Type

- Synthetic

- Renewable

- By Application

- Animal Feed

- Chemical Intermediate

- Food and Flavors

- Pharmaceuticals

- Perfumes

- Others

- By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

- Butyric acid prices remained firm at elevated levels as supply constraints limited production and suppliers maintained stable offers.

- A leading chemical producer faced an unplanned outage in its intermediates division, reducing output and pressuring availability of butyric acid derivatives.

- A major European producer resumed normal operations after lifting a force majeure that had restricted supply of n-butyric and isobutyric acids.

- The same producer earlier declared force majeure due to a raw material supply disruption, which impacted the availability of both n-butyric acid and isobutyric acid in the market.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The N-butyric and isobutyric acid Market is estimated to reach USD 314.2 million by 2032.

The Global N-butyric and isobutyric acid Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% during the forecast period from 2025 to 2032.

The Global N-butyric and isobutyric acid Market is estimated to generate USD 187 million in revenue in 2024.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!