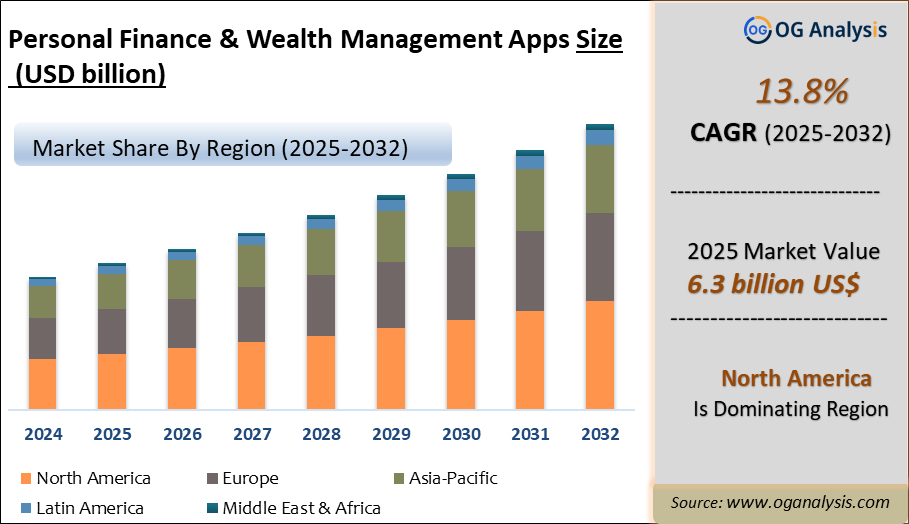

"The Global Personal Finance and Wealth Management Apps Market Size was valued at USD 5.7 billion in 2024 and is projected to reach USD 6.3 billion in 2025. Worldwide sales of Personal Finance and Wealth Management Apps are expected to grow at a significant CAGR of 13.8%, reaching USD 20.9 billion by the end of the forecast period in 2034."

Personal Finance and Wealth Management Apps Market Overview

The personal finance and wealth management apps market has experienced robust growth in recent years, driven by the increasing demand for digital solutions that enable individuals to manage their finances effectively. These apps offer a wide range of functionalities, including budgeting, expense tracking, investment management, and financial planning. The convenience and accessibility of mobile apps have revolutionized how people approach their financial health, providing real-time insights and personalized recommendations. With the proliferation of smartphones and internet connectivity, the adoption of personal finance apps has surged, catering to a diverse user base ranging from millennials to high-net-worth individuals. The market is characterized by continuous innovation, with app developers integrating advanced technologies such as artificial intelligence (AI) and machine learning (ML) to enhance user experience and provide more accurate financial advice.

The COVID-19 pandemic has further accelerated the adoption of personal finance and wealth management apps as people sought to gain better control over their finances amidst economic uncertainties. The shift towards remote work and digital lifestyles has emphasized the need for efficient financial management tools that can be accessed anytime and anywhere. Additionally, the growing awareness of financial literacy and the importance of financial planning has spurred the demand for these apps. Financial institutions and fintech companies are increasingly collaborating to develop comprehensive solutions that address the evolving needs of consumers. As the market continues to expand, personal finance and wealth management apps are poised to play a crucial role in helping individuals achieve their financial goals and secure their financial future.

Latest Trends

One of the latest trends in the personal finance and wealth management apps market is the integration of AI and ML technologies. These technologies enable apps to provide personalized financial advice, predictive analytics, and automated investment management. By analyzing user behavior and financial data, AI-powered apps can offer tailored recommendations and alerts, helping users make informed decisions. Another significant trend is the rise of robo-advisors, which use algorithms to manage investments and provide financial planning services with minimal human intervention. These robo-advisors are gaining popularity due to their cost-effectiveness and accessibility, making professional financial management services available to a broader audience.

The increasing focus on holistic financial wellness is also shaping the market. Modern personal finance apps are not just limited to budgeting and expense tracking but are evolving to include features like credit score monitoring, debt management, and retirement planning. These comprehensive solutions aim to provide users with a 360-degree view of their financial health. Additionally, the trend towards open banking is facilitating the integration of various financial accounts and services into a single app, offering users a seamless and unified experience. Open banking allows users to link their bank accounts, credit cards, investment portfolios, and other financial products, enabling better management and visibility of their finances.

Drivers

Several key drivers are propelling the growth of the personal finance and wealth management apps market. The increasing penetration of smartphones and internet connectivity is a primary driver, as it provides the necessary infrastructure for the widespread adoption of these apps. The rising awareness of financial literacy and the importance of personal finance management is also contributing to market growth. Consumers are becoming more proactive about managing their finances and seeking tools that offer convenience and efficiency. The collaboration between fintech companies and traditional financial institutions is another significant driver. By leveraging each other's strengths, they are developing innovative solutions that cater to the diverse needs of consumers. Furthermore, the regulatory environment is evolving to support the growth of fintech and digital financial services, encouraging the development and adoption of personal finance apps.

Market Challenges

Despite the promising growth prospects, the personal finance and wealth management apps market faces several challenges. One of the primary challenges is ensuring data security and privacy. As these apps handle sensitive financial information, they are prime targets for cyber-attacks and data breaches. Ensuring robust security measures and compliance with regulatory standards is crucial to gaining user trust and protecting their data. Another challenge is the high competition in the market. With numerous apps offering similar functionalities, differentiating and retaining users can be challenging. Additionally, the reliance on technology means that any technical glitches or downtime can significantly impact user experience and satisfaction. Addressing these challenges is essential for sustaining growth and maintaining a competitive edge in the market.

Major Players in the Personal Finance and Wealth Management Apps Market

1. Mint

2. YNAB (You Need A Budget)

3. Personal Capital

4. Quicken

5. Acorns

6. Robinhood

7. Wealthfront

8. Betterment

9. Stash

10. PocketGuard

11. Goodbudget

12. Clarity Money

13. Digit

14. Mvelopes

15. Prism

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By Type, By Platform, By End-User |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

- By Type:

- Budgeting Apps

- Investment Apps

- Financial Planning Apps

- By Platform:

- iOS

- Android

- Web-based

- By End User:

- Individuals

- SMEs

- Large Enterprises

- By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Personal Finance and Wealth Management Apps Market is estimated to generate USD 5.7 billion in revenue in 2024.

The Global Personal Finance and Wealth Management Apps Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% during the forecast period from 2025 to 2032.

The Personal Finance and Wealth Management Apps Market is estimated to reach USD 16 billion by 2032.

$4150- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!