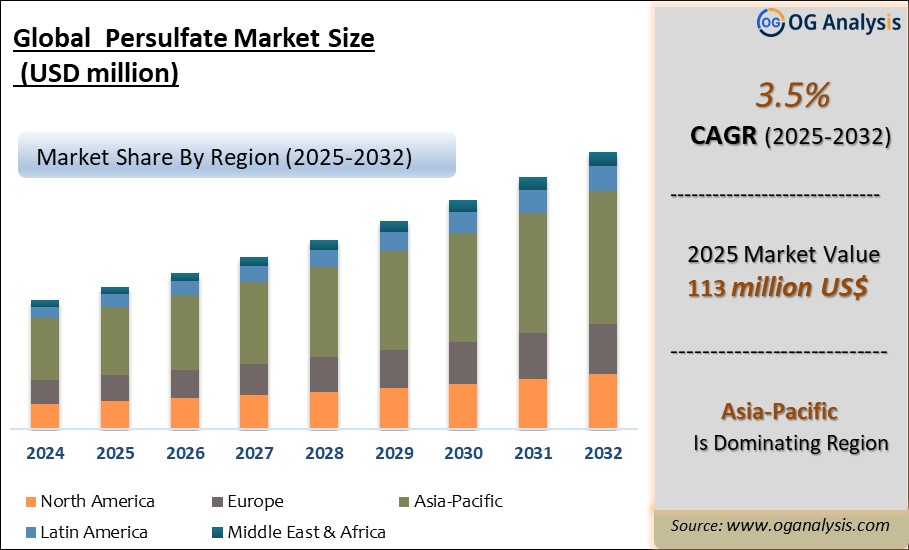

"The Global Persulfate Market is valued at USD 113 Million in 2025. Worldwide sales of Advanced Lead Acid Battery Market are expected to grow at a significant CAGR of 3.5%, reaching USD 143.8 Million by the end of the forecast period in 2032."

"Sustainability and Industrial Growth Propel the Persulfate Market: Exploring Key Trends and Emerging Opportunities"

Market Introduction and Overview

The Persulfate Market is witnessing notable expansion, driven by its broad applications across multiple industries, including electronics, cosmetics, water treatment, and textiles. Persulfates, including ammonium, sodium, and potassium persulfates, are widely used as strong oxidizing agents due to their stability and high reactivity. In 2024, the market has seen increased demand from the electronics sector, where persulfates are essential in etching printed circuit boards and in semiconductor manufacturing. Additionally, the cosmetics industry is leveraging persulfates as bleaching agents in hair dyes and other beauty products, further driving market growth. Environmental concerns have also led to increased use of persulfates in soil and groundwater remediation projects, providing an eco-friendly solution to pollution.

Looking forward to 2025, the Persulfate Market is expected to continue its upward trajectory, fueled by the growing adoption of sustainable practices across industries. As companies and governments prioritize cleaner and greener production processes, the demand for persulfates in applications such as water treatment, where they help degrade organic contaminants, is projected to rise. The electronics industry is also expected to be a major contributor to growth, as the increasing global demand for smartphones, tablets, and other electronic devices drives the need for advanced manufacturing materials like persulfates. These factors position the persulfate market for sustained growth, with new opportunities emerging in several sectors.

Persulfate Market Latest Trends, Drivers and Challenges

One of the key trends shaping the Persulfate Market is the increasing emphasis on sustainability. In 2024, companies across industries have been actively seeking more environmentally friendly solutions for their production processes, and persulfates are playing a pivotal role in this transition. Persulfates are increasingly being used in water and wastewater treatment processes, where their strong oxidative properties help break down harmful organic compounds and contaminants. This trend is expected to gain momentum in 2025, as stricter environmental regulations push industries to adopt greener chemicals for pollution control and remediation.

The electronics industry is also experiencing significant growth in the use of persulfates, particularly in the manufacture of printed circuit boards (PCBs) and semiconductors. Persulfates are used as etching agents to create fine and precise patterns on silicon wafers and PCBs, making them indispensable in the production of electronic components. With the rapid pace of technological advancements and the growing demand for smaller, more powerful electronic devices, the need for high-quality etching agents is expected to drive the demand for persulfates. The ongoing expansion of the electronics industry, especially in Asia-Pacific, further reinforces this trend.

The rising focus on environmental remediation is a key driver of the Persulfate Market’s growth. Persulfates are increasingly being used in in-situ chemical oxidation (ISCO) processes to remediate contaminated soil and groundwater. As environmental concerns intensify and governments implement stricter regulations on industrial pollution, the demand for effective remediation chemicals is on the rise. Persulfates are considered an effective and environmentally friendly option for degrading hydrocarbons, pesticides, and other pollutants in contaminated sites, making them an essential tool in global environmental protection efforts.

Additionally, the expansion of the cosmetics and personal care industry is expected to drive the demand for persulfates, particularly in hair care products. Persulfates are widely used as bleaching agents in hair dyes, and the growing trend of self-care and beauty enhancement is fueling the demand for hair coloring products globally. Furthermore, as consumers increasingly opt for sustainable and high-performance beauty products, manufacturers are focusing on safer and more effective formulations that include persulfates. These trends, along with the ongoing growth in the electronics sector, are expected to create significant opportunities for the persulfate market in the years ahead.

Despite the positive growth outlook, the Persulfate Market faces several challenges. One of the key issues is the volatility in raw material prices, which can impact the overall cost structure of persulfate production. Persulfates are derived from sulfuric acid and related compounds, and fluctuations in the prices of these raw materials can affect profitability for manufacturers. In addition, the energy-intensive nature of persulfate production poses another challenge, particularly in regions where energy costs are rising. Managing these operational costs while maintaining competitive pricing is crucial for market players.

Health and safety concerns related to the handling and use of persulfates also pose a challenge. Persulfates, particularly in high concentrations, can cause irritation to the skin, eyes, and respiratory system, which raises concerns about their safe use in consumer products and industrial applications. Manufacturers need to ensure compliance with safety regulations and provide adequate handling instructions and safety measures to mitigate risks. Addressing these challenges through innovation, cost management, and safety protocols will be essential for sustained market growth.

Competitive Landscape and Key Strategies

The Persulfate Market is highly competitive, with several key players vying for market share through innovation and strategic partnerships. Leading companies are focusing on expanding their product portfolios to cater to the diverse needs of end-user industries such as electronics, cosmetics, and environmental remediation. Research and development (R&D) initiatives are a core strategy, with companies investing in the development of new formulations that offer higher performance and better environmental outcomes. For instance, some manufacturers are exploring the use of persulfates in more advanced applications, such as advanced oxidation processes (AOP) for water treatment.

In addition to innovation, partnerships and collaborations with research institutions and industrial end-users are becoming increasingly common as companies aim to strengthen their market presence. These collaborations help companies gain insights into emerging industry trends and customer needs, allowing them to develop more targeted solutions. Furthermore, sustainability is a growing focus for many companies, with efforts to reduce the environmental footprint of their production processes and offer eco-friendly alternatives to traditional chemicals. By adopting these strategies, leading players are positioning themselves to capitalize on the growing demand for persulfates across a range of industries.

Market Players

Key companies operating in the Persulfate Market include:

1. PeroxyChem LLC (Evonik Industries)

2. United Initiators GmbH

3. Mitsubishi Gas Chemical Company

4. Fujifilm Holdings Corporation

5. DuPont de Nemours, Inc.

6. ADEKA Corporation

7. Yatai Electrochemistry Co., Ltd.

8. ABC Chemicals (Shanghai) Co., Ltd.

9. Hebei Jiheng Group Co., Ltd.

10. RheinPerChemie GmbH

11. Merck KGaA

12. UPL Limited

13. Lanxess AG

14. AK Scientific, Inc.

15. Honeywell International Inc.

Market scope

| Parameter | Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD Million |

| Market Splits Covered | By Type, and By End-User |

| Countries Covered | North America (USA, Canada, Mexico) Europe (Germany, UK, France, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, Rest of APAC) The Middle East and Africa (Middle East, Africa) South and Central America (Brazil, Argentina, Rest of SCA) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Datafile |

Market Segmentation

By Type

- Ammonium

- Potassium

- Sodium

By End Use

- Polymers

- Electronics

- Cosmetics & Personal Care

- Pulp, Paper & Textiles

- Oil & Gas

- Water Treatment

- Soil Remediation

- Others

By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Persulfate Market is estimated to generate USD 113 million in revenue in 2025

The Global Persulfate Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% during the forecast period from 2025 to 2031.

By 2031, the Persulfate Market is estimated to account for USD 143.8 million

$3950- 5%

$6450- 10%

$8450- 15%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!