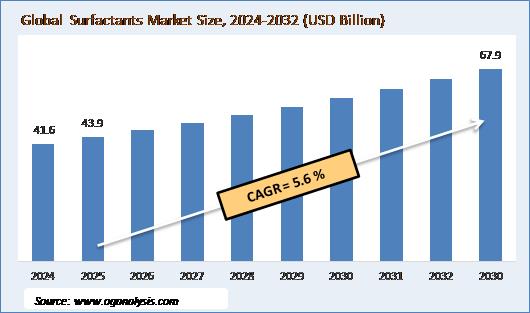

"The Global Surfactants Market is valued at USD 41.6 billion in 2024. Worldwide sales of Surfactants Market are expected to grow at a significant CAGR of 5.6%, reaching USD 64.33 billion by the end of the forecast period in 2032."

Surfactants Market Introduction and Overview

The surfactants market is a dynamic and ever-evolving sector that plays a pivotal role in numerous industries. Surfactants, or surface-active agents, are chemical compounds that reduce surface tension between liquids, solids, and gases. These versatile substances are widely used in industries such as personal care, detergents, agrochemicals, oil and gas, and industrial applications. The growing demand for household and industrial cleaning products, coupled with the expanding application of surfactants in cosmetic formulations, has significantly boosted market growth. In recent years, surfactants have also found their place in the food and beverage, textile, and pharmaceutical industries, further contributing to the market's expansion. Increasing urbanization, a growing consumer base, and shifting consumer preferences towards eco-friendly and sustainable products have provided additional momentum to the surfactants market. Manufacturers are increasingly focusing on innovation and the development of bio-based, biodegradable surfactants to cater to these changing demands, while also addressing environmental concerns associated with traditional surfactants.

The surfactants market is segmented based on product types such as anionic, cationic, non-ionic, and amphoteric surfactants. Among these, anionic surfactants are the most widely used due to their superior cleaning properties and cost-effectiveness. Non-ionic surfactants are also gaining popularity due to their mildness and reduced toxicity, making them ideal for personal care and cosmetics applications. Cationic surfactants, known for their anti-static and antimicrobial properties, find applications in fabric softeners, hair conditioners, and other specialty products. The market's growth is also driven by technological advancements that improve the performance and functionality of surfactants, alongside stringent environmental regulations that promote the shift to more sustainable alternatives. The rise of green chemistry has propelled the demand for surfactants derived from renewable sources, offering eco-friendly options that are biodegradable and have lower toxicity levels. This trend is expected to continue gaining traction as businesses and consumers alike become more conscious of the environmental impact of their purchasing choices, creating new opportunities for market players to innovate and expand their product portfolios.

Latest Trends in the Surfactants Market

One of the prominent trends in the surfactants market is the increasing shift towards sustainable and eco-friendly surfactant products. Consumers and industries are becoming more environmentally conscious, prompting manufacturers to develop biodegradable and non-toxic alternatives. Bio-based surfactants, derived from renewable resources such as plant oils, sugars, and natural fats, are gaining significant traction. These products are not only sustainable but also perform well in terms of efficacy and safety. In addition to the environmental benefits, bio-based surfactants often meet the growing demand for "green" certifications in various industries such as cosmetics, personal care, and cleaning products. As sustainability becomes a key concern, manufacturers are investing in research and development (R&D) to create surfactants that are both functional and eco-friendly, catering to the evolving demands of the market.

Another key trend is the increasing use of surfactants in personal care and cosmetic formulations. Surfactants are essential in the formulation of a wide range of products such as shampoos, conditioners, body washes, and facial cleansers. With the rising consumer demand for high-quality personal care products, manufacturers are focusing on creating surfactants that offer enhanced skin compatibility, mildness, and improved sensory experiences. The growing trend towards "clean beauty" and the demand for products with fewer synthetic chemicals have driven the preference for surfactants derived from natural sources. Additionally, surfactants are being integrated into new product categories such as anti-aging creams, sunscreens, and other therapeutic skin treatments, further expanding their application range in the cosmetics sector.

Furthermore, the increasing demand for surfactants in the oil and gas industry is an emerging trend in the market. Surfactants play a crucial role in oil recovery, fracking fluids, and enhanced oil recovery (EOR) processes. They are used to reduce the surface tension between the oil and water, which improves the efficiency of extraction processes. As global energy demand rises, there is a greater focus on improving the efficiency of oil and gas extraction techniques, further driving the demand for surfactants. Additionally, surfactants are also employed in cleaning and maintenance activities within the oil and gas industry. The development of surfactants that can perform effectively in high temperatures and harsh conditions is a key area of innovation within this sector, as industries strive to enhance operational efficiency and reduce costs.

Market Drivers in the Surfactants Industry

The surfactants market is experiencing significant growth due to several key drivers. The rising demand for household and industrial cleaning products is a primary factor contributing to the market's expansion. Surfactants are integral components of detergents, surface cleaners, dishwashing liquids, and other cleaning formulations due to their ability to break down grease and remove dirt effectively. As urbanization increases, there is a greater need for cleaning products, especially in emerging economies where disposable incomes are rising, and there is a growing preference for convenience. Additionally, the expansion of industries such as automotive, textiles, and healthcare further fuels the demand for surfactants in cleaning and maintenance applications.

Another significant driver of the surfactants market is the growing demand for personal care and cosmetic products. With the increase in disposable income and changing lifestyles, consumers are becoming more inclined to purchase high-quality skincare, haircare, and beauty products. Surfactants, which are essential for emulsification, foaming, and cleansing in these products, are seeing increased demand. The desire for natural, organic, and sustainably sourced beauty products is also influencing market growth. Consumers are increasingly opting for cosmetics and personal care items that are free from harmful chemicals, driving the demand for mild and bio-based surfactants that meet these standards.

Technological advancements and innovations in surfactant production are further accelerating market growth. Manufacturers are adopting advanced technologies to improve the performance and functionality of surfactants, enhancing their applications in various industries. The growing adoption of green chemistry principles is encouraging the development of sustainable surfactants with lower environmental impact. This shift toward sustainability, combined with the demand for high-performance surfactants, is creating new opportunities for innovation. Furthermore, the rise in research and development activities aimed at improving surfactant formulations to meet the diverse needs of end-users is fostering the market’s evolution. Manufacturers are increasingly focused on creating multifunctional surfactants that cater to the varying demands of sectors like automotive, pharmaceuticals, and oil and gas.

Challenges in the Surfactants Market

Despite its growth potential, the surfactants market faces several challenges that could hinder its development. One of the main challenges is the volatility of raw material prices, particularly the costs associated with petrochemical-based feedstocks. The reliance on petroleum for the production of many conventional surfactants exposes manufacturers to price fluctuations in the global oil market. This unpredictability in raw material costs can create uncertainty for businesses and make it difficult to maintain consistent pricing for surfactants. Additionally, while the demand for bio-based surfactants is rising, the higher cost of production compared to traditional surfactants remains a challenge for manufacturers, limiting their widespread adoption in some industries.

By Product Type

- Anionic Surfactants

- Amphoteric Surfactants

- Cationic Surfactants

- Non-Ionic Surfactants

- Others

By Substrate

- Bio-Based

- Synthetic

By Application

- Personal Care

- Textiles

- Industrial

- Agriculture

- Food and Beverage

- Plastics and Adhesives

- Others

Key Market Players Presented in the Report Include

BASF SE

Stepan Company

Evonik Industries AG

Dow Inc.

Nouryon

Solvay S.A.

Clariant AG

Kao Corporation

Croda International Plc

Indorama Ventures Public Company Limited

Galaxy Surfactants Limited

Oxiteno

SNF Floerger

Inolex

Windtree Therapeutics

1. Table of Contents

1.1 List of Tables

1.2 List of Figures

2. Global Surfactants Market Review, 2024

2.1 Surfactants Industry Overview

2.2 Research Methodology

3. Surfactants Market Insights

3.1 Surfactants Market Trends to 2032

3.2 Future Opportunities in Surfactants Market

3.3 Dominant Applications of Surfactants, 2024 Vs 2032

3.4 Key Types of Surfactants, 2024 Vs 2032

3.5 Leading End Uses of Surfactants Market, 2024 Vs 2032

3.6 High Prospect Countries for Surfactants Market, 2024 Vs 2032

4. Surfactants Market Trends, Drivers, and Restraints

4.1 Latest Trends and Recent Developments in Surfactants Market

4.2 Key Factors Driving the Surfactants Market Growth

4.2 Major Challenges to the Surfactants industry, 2024- 2032

4.3 Impact of Wars and geo-political tensions on Surfactants supply chain

5 Five Forces Analysis for Global Surfactants Market

5.1 Surfactants Industry Attractiveness Index, 2024

5.2 Surfactants Market Threat of New Entrants

5.3 Surfactants Market Bargaining Power of Suppliers

5.4 Surfactants Market Bargaining Power of Buyers

5.5 Surfactants Market Intensity of Competitive Rivalry

5.6 Surfactants Market Threat of Substitutes

6. Global Surfactants Market Data – Industry Size, Share, and Outlook

6.1 Surfactants Market Annual Sales Outlook, 2024- 2032 ($ Million)

6.1 Global Surfactants Market Annual Sales Outlook by Type, 2024- 2032 ($ Million)

6.2 Global Surfactants Market Annual Sales Outlook by Application, 2024- 2032 ($ Million)

6.3 Global Surfactants Market Annual Sales Outlook by End-User, 2024- 2032 ($ Million)

6.4 Global Surfactants Market Annual Sales Outlook by Region, 2024- 2032 ($ Million)

7. Asia Pacific Surfactants Industry Statistics – Market Size, Share, Competition and Outlook

7.1 Asia Pacific Market Insights, 2024

7.2 Asia Pacific Surfactants Market Revenue Forecast by Type, 2024- 2032 (USD Million)

7.3 Asia Pacific Surfactants Market Revenue Forecast by Application, 2024- 2032(USD Million)

7.4 Asia Pacific Surfactants Market Revenue Forecast by End-User, 2024- 2032 (USD Million)

7.5 Asia Pacific Surfactants Market Revenue Forecast by Country, 2024- 2032 (USD Million)

7.5.1 China Surfactants Analysis and Forecast to 2032

7.5.2 Japan Surfactants Analysis and Forecast to 2032

7.5.3 India Surfactants Analysis and Forecast to 2032

7.5.4 South Korea Surfactants Analysis and Forecast to 2032

7.5.5 Australia Surfactants Analysis and Forecast to 2032

7.5.6 Indonesia Surfactants Analysis and Forecast to 2032

7.5.7 Malaysia Surfactants Analysis and Forecast to 2032

7.5.8 Vietnam Surfactants Analysis and Forecast to 2032

7.6 Leading Companies in Asia Pacific Surfactants Industry

8. Europe Surfactants Market Historical Trends, Outlook, and Business Prospects

8.1 Europe Key Findings, 2024

8.2 Europe Surfactants Market Size and Percentage Breakdown by Type, 2024- 2032 (USD Million)

8.3 Europe Surfactants Market Size and Percentage Breakdown by Application, 2024- 2032 (USD Million)

8.4 Europe Surfactants Market Size and Percentage Breakdown by End-User, 2024- 2032 (USD Million)

8.5 Europe Surfactants Market Size and Percentage Breakdown by Country, 2024- 2032 (USD Million)

8.5.1 2024 Germany Surfactants Market Size and Outlook to 2032

8.5.2 2024 United Kingdom Surfactants Market Size and Outlook to 2032

8.5.3 2024 France Surfactants Market Size and Outlook to 2032

8.5.4 2024 Italy Surfactants Market Size and Outlook to 2032

8.5.5 2024 Spain Surfactants Market Size and Outlook to 2032

8.5.6 2024 BeNeLux Surfactants Market Size and Outlook to 2032

8.5.7 2024 Russia Surfactants Market Size and Outlook to 2032

8.6 Leading Companies in Europe Surfactants Industry

9. North America Surfactants Market Trends, Outlook, and Growth Prospects

9.1 North America Snapshot, 2024

9.2 North America Surfactants Market Analysis and Outlook by Type, 2024- 2032($ Million)

9.3 North America Surfactants Market Analysis and Outlook by Application, 2024- 2032($ Million)

9.4 North America Surfactants Market Analysis and Outlook by End-User, 2024- 2032($ Million)

9.5 North America Surfactants Market Analysis and Outlook by Country, 2024- 2032($ Million)

9.5.1 United States Surfactants Market Analysis and Outlook

9.5.2 Canada Surfactants Market Analysis and Outlook

9.5.3 Mexico Surfactants Market Analysis and Outlook

9.6 Leading Companies in North America Surfactants Business

10. Latin America Surfactants Market Drivers, Challenges, and Growth Prospects

10.1 Latin America Snapshot, 2024

10.2 Latin America Surfactants Market Future by Type, 2024- 2032($ Million)

10.3 Latin America Surfactants Market Future by Application, 2024- 2032($ Million)

10.4 Latin America Surfactants Market Future by End-User, 2024- 2032($ Million)

10.5 Latin America Surfactants Market Future by Country, 2024- 2032($ Million)

10.5.1 Brazil Surfactants Market Analysis and Outlook to 2032

10.5.2 Argentina Surfactants Market Analysis and Outlook to 2032

10.5.3 Chile Surfactants Market Analysis and Outlook to 2032

10.6 Leading Companies in Latin America Surfactants Industry

11. Middle East Africa Surfactants Market Outlook and Growth Prospects

11.1 Middle East Africa Overview, 2024

11.2 Middle East Africa Surfactants Market Statistics by Type, 2024- 2032 (USD Million)

11.3 Middle East Africa Surfactants Market Statistics by Application, 2024- 2032 (USD Million)

11.4 Middle East Africa Surfactants Market Statistics by End-User, 2024- 2032 (USD Million)

11.5 Middle East Africa Surfactants Market Statistics by Country, 2024- 2032 (USD Million)

11.5.1 South Africa Surfactants Market Outlook

11.5.2 Egypt Surfactants Market Outlook

11.5.3 Saudi Arabia Surfactants Market Outlook

11.5.4 Iran Surfactants Market Outlook

11.5.5 UAE Surfactants Market Outlook

11.6 Leading Companies in Middle East Africa Surfactants Business

12. Surfactants Market Structure and Competitive Landscape

12.1 Key Companies in Surfactants Business

12.2 Surfactants Key Player Benchmarking

12.3 Surfactants Product Portfolio

12.4 Financial Analysis

12.5 SWOT and Financial Analysis Review

14. Latest News, Deals, and Developments in Surfactants Market

14.1 Surfactants trade export, import value and price analysis

15 Appendix

15.1 Publisher Expertise

15.2 Surfactants Industry Report Sources and Methodology

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Surfactants Market is estimated to generate USD 41.6 Billion in revenue in 2024.

The Global Surfactants Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period from 2025 to 2032.

The Surfactants Market is estimated to reach USD 64.33 Billion by 2032.

$3950- 5%

$6450- 10%

$8450- 15%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!