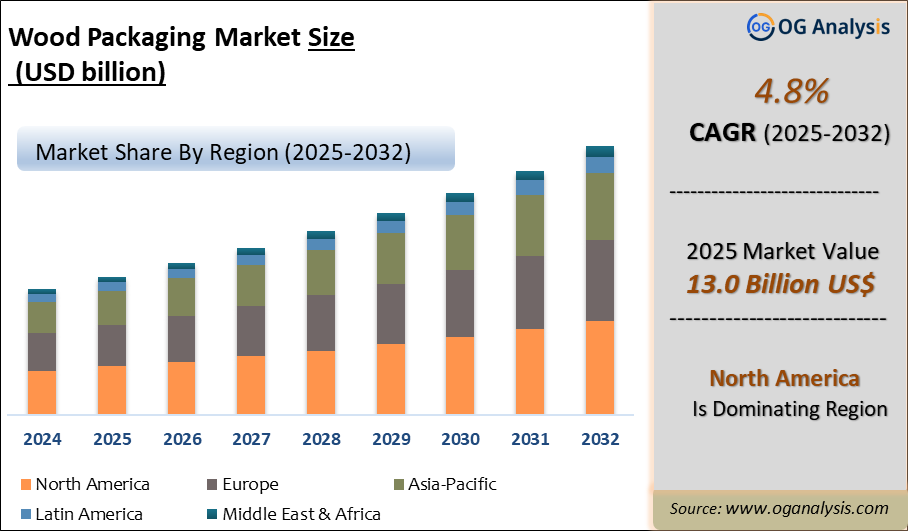

"The Global Wood Packaging Market Size was valued at USD 12.5 billion in 2024 and is projected to reach USD 13.0 billion in 2025. Worldwide sales of Wood Packaging are expected to grow at a significant CAGR of 4.8%, reaching USD 20.2 billion by the end of the forecast period in 2034."

Introduction and Overview

The wood packaging market has emerged as a vital segment within the global packaging industry, driven by the increasing demand for sustainable and eco-friendly packaging solutions. As environmental concerns and regulatory frameworks push for reduced reliance on plastic and other non-biodegradable materials, wood packaging offers a viable alternative due to its renewable nature and recyclability. Wood packaging encompasses a diverse range of products, including pallets, crates, boxes, and barrels, which are extensively used across various industries such as food and beverage, pharmaceuticals, and consumer goods. The versatility and robustness of wood packaging make it a preferred choice for shipping and storage, providing both durability and aesthetic appeal. With the growing trend towards sustainable practices and the need for effective supply chain management, the wood packaging market is experiencing robust growth and innovation.

Geographically, the wood packaging market shows varied growth patterns, with significant developments in regions such as North America, Europe, and Asia-Pacific. North America and Europe are leading due to stringent regulations on plastic use and increased consumer awareness about sustainability. In contrast, the Asia-Pacific region is witnessing rapid expansion owing to its burgeoning manufacturing sector and rising industrialization. The market dynamics are also influenced by advancements in wood treatment technologies and innovations in design, which enhance the functionality and appeal of wood packaging. As companies and consumers alike prioritize eco-conscious choices, the wood packaging market is poised for continued growth, reflecting a broader shift towards greener practices and sustainable materials.

Trade Intelligence for wood packaging market

| Global Pallets, box pallets and other load boards, of wood Trade, Imports, USD million, 2020-24 | |||||

|

| 2020 | 2021 | 2022 | 2023 | 2024 |

| World | 2,541 | 4,044 | 4,934 | 3,766 | 3,484 |

| Germany | 446 | 829 | 1,002 | 598 | 513 |

| Italy | 173 | 321 | 400 | 323 | 307 |

| France | 200 | 327 | 401 | 315 | 271 |

| Netherlands | 163 | 295 | 399 | 283 | 258 |

| Belgium | 179 | 266 | 317 | 240 | 210 |

| Source: OGAnalysis, International Trade Centre (ITC) | |||||

- Germany, Italy, France, Netherlands and Belgium are the top five countries importing 44.8% of global Pallets, box pallets and other load boards, of wood in 2024

- Global Pallets, box pallets and other load boards, of wood Imports increased by 37.1% between 2020 and 2024

- Germany accounts for 14.7% of global Pallets, box pallets and other load boards, of wood trade in 2024

- Italy accounts for 8.8% of global Pallets, box pallets and other load boards, of wood trade in 2024

- France accounts for 7.8% of global Pallets, box pallets and other load boards, of wood trade in 2024

| Global Pallets, box pallets and other load boards, of wood Export Prices, USD/Ton, 2020-24 |

|

|

| Source: OGAnalysis |

Latest Trends

One of the most notable trends in the wood packaging market is the rise in demand for customized and innovative packaging solutions. Companies are increasingly opting for tailored designs that not only cater to specific product requirements but also enhance brand identity and consumer experience. This shift towards personalization is driven by the need to stand out in a competitive market and create memorable unboxing experiences. Additionally, advancements in digital printing and wood processing technologies have made it easier to produce high-quality, customized wood packaging that meets both aesthetic and functional needs.

Another key trend is the integration of technology into wood packaging solutions. Smart packaging, which incorporates technologies such as RFID tags and QR codes, is gaining traction in the wood packaging industry. These innovations allow for better tracking, inventory management, and interactive consumer engagement. For instance, RFID technology can help monitor the condition of goods during transit and provide real-time data on their location, thereby enhancing supply chain efficiency and reducing losses. This technological evolution reflects the broader trend of incorporating digital solutions into traditional packaging methods to address modern logistical and marketing challenges.

Sustainability remains a dominant trend influencing the wood packaging market. The increasing emphasis on reducing environmental impact has led to greater adoption of certified sustainable wood sources and eco-friendly production practices. The Forest Stewardship Council (FSC) certification and similar initiatives are becoming essential for companies aiming to demonstrate their commitment to responsible sourcing and environmental stewardship. Furthermore, innovations in wood recycling and reuse are gaining momentum, as businesses seek to minimize waste and extend the lifecycle of their packaging materials. This focus on sustainability not only aligns with regulatory requirements but also resonates with environmentally conscious consumers, driving further growth in the market.

Drivers

The primary driver of growth in the wood packaging market is the increasing consumer and regulatory push for sustainable and eco-friendly packaging solutions. Governments and organizations worldwide are implementing regulations to reduce plastic waste and encourage the use of renewable materials, making wood packaging a favorable alternative. The natural biodegradability and recyclability of wood align with these sustainability goals, fostering a shift away from plastics and other harmful materials. As consumers become more environmentally conscious, their preference for products packaged in sustainable materials further fuels the demand for wood packaging solutions.

Additionally, the rising global trade and e-commerce activities are contributing to the growth of the wood packaging market. The need for durable and reliable packaging solutions to safeguard goods during transit and storage drives the demand for wood-based products. Wood packaging, with its strength and adaptability, provides an effective solution for protecting goods across various supply chains. The expansion of e-commerce platforms and international trade is increasing the volume of goods transported, thereby boosting the requirement for robust and cost-effective packaging solutions.

Technological advancements in wood processing and treatment are also playing a significant role in driving the market. Innovations such as improved wood preservation techniques, advanced treatment methods, and enhanced design capabilities are expanding the functionality and appeal of wood packaging. These advancements enable manufacturers to produce high-quality, durable, and aesthetically pleasing packaging solutions that meet the diverse needs of different industries. The ongoing research and development efforts aimed at enhancing wood packaging technology are expected to further stimulate market growth and introduce new opportunities for industry players.

Market Challenges

Despite its growth prospects, the wood packaging market faces several challenges. One of the primary concerns is the fluctuating availability and cost of raw materials. Wood, being a natural resource, is subject to supply chain disruptions and price volatility influenced by factors such as environmental regulations, logging restrictions, and changes in forest management practices. These fluctuations can impact the production costs of wood packaging and pose challenges for manufacturers in maintaining price stability. Additionally, the market must address issues related to wood sourcing and sustainability, ensuring that wood used in packaging comes from responsibly managed forests to meet regulatory and consumer expectations.

Market Players

1. Greif, Inc.

2. Sonoco Products Company

3. International Paper Company

4. WestRock Company

5. Pratt Industries, Inc.

6. Packaging Corporation of America

7. Smurfit Kappa Group plc

8. Menasha Corporation

9. Georgia-Pacific LLC

10. Weyerhaeuser Company

Report Scope

| Parameter | wood packaging market scope Detail |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2026-2032 |

| Market Size-Units | USD billion |

| Market Splits Covered | By product, By Application |

| Countries Covered | North America (USA, Canada, Mexico) |

| Analysis Covered | Latest Trends, Driving Factors, Challenges, Trade Analysis, Price Analysis, Supply-Chain Analysis, Competitive Landscape, Company Strategies |

| Customization | 10% free customization (up to 10 analyst hours) to modify segments, geographies, and companies analyzed |

| Post-Sale Support | 4 analyst hours, available up to 4 weeks |

| Delivery Format | The Latest Updated PDF and Excel Data file |

Market Segmentation

- By Product

- Pallets

- Cases and boxes

- By Application

- Food and beverages storage

- Transportation

- Industrial

- Shipping

- Others

- By Geography

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Recent Developments

- A leading manufacturer expanded its additive manufacturing capacity by integrating multiple advanced metal 3D printing systems to strengthen industrial production.

- A space technology company launched a large-format additive manufacturing facility dedicated to aerospace and rocket components, enabling streamlined design-to-production workflows.

- An established 3D printing provider advanced its aerospace portfolio by developing a large-format metal 3D printing demonstrator designed for high-temperature flight applications.

- A stainless steel producer entered the aerospace additive manufacturing supply chain by delivering its first commercial batches of specialized metal powders for aviation.

- A global materials company achieved a milestone of producing over 25,000 3D-printed defense components using proprietary metal powder technology.

- A technology giant introduced new metal additive manufacturing innovations and partnerships aimed at lowering costs and scaling adoption across automotive and industrial markets.

- A directed energy deposition specialist expanded its presence with a new application development center focused on advanced AM technologies, earning significant industry recognition.

Research Methodology

Our research methodology combines primary and secondary research techniques to ensure comprehensive market analysis.

Primary Research

We conduct extensive interviews with industry experts, key opinion leaders, and market participants to gather first-hand insights.

Secondary Research

Our team analyzes published reports, company websites, financial statements, and industry databases to validate our findings.

Data Analysis

We employ advanced analytical tools and statistical methods to process and interpret market data accurately.

Get Free Sample

At OG Analysis, we understand the importance of informed decision-making in today's dynamic business landscape. To help you experience the depth and quality of our market research reports, we offer complimentary samples tailored to your specific needs.

Start Now! Please fill the form below for your free sample.

Why Request a Free Sample?

Evaluate Our Expertise: Our reports are crafted by industry experts and seasoned analysts. Requesting a sample allows you to assess the depth of research and the caliber of insights we provide.

Tailored to Your Needs: Let us know your industry, market segment, or specific topic of interest. Our free samples are customized to ensure relevance to your business objectives.

Witness Actionable Insights: See firsthand how our reports go beyond data, offering actionable insights and strategic recommendations that can drive your business forward.

Embark on your journey towards strategic decision-making by requesting a free sample from OG Analysis. Experience the caliber of insights that can transform the way you approach your business challenges.

FAQ's

The Global Wood Packaging Market is estimated to generate USD 12.5 billion in revenue in 2024.

The Global Wood Packaging Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2025 to 2032.

The Wood Packaging Market is estimated to reach USD 18.2 billion by 2032.

$3950- 30%

$6450- 40%

$8450- 50%

$2850- 20%

Didn’t find what you’re looking for? TALK TO OUR ANALYST TEAM

Need something within your budget? NO WORRIES! WE GOT YOU COVERED!